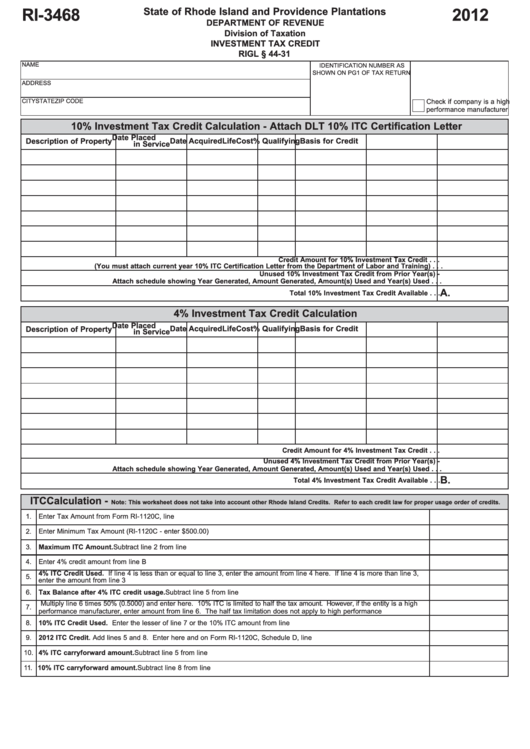

State of Rhode Island and Providence Plantations

RI-3468

2012

DEPARTMENT OF REVENUE

Division of Taxation

INVESTMENT TAX CREDIT

RIGL § 44-31

NAME

IDENTIFICATION NUMBER AS

U.S. BUSINESS CODE NUMBER

SHOWN ON PG1 OF TAX RETURN

ADDRESS

CITY

STATE

ZIP CODE

Check if company is a high

performance manufacturer

10% Investment Tax Credit Calculation - Attach DLT 10% ITC Certification Letter

Date Placed

Description of Property

Date Acquired

Life

Cost

% Qualifying

Basis for Credit

in Service

Credit Amount for 10% Investment Tax Credit . . .

(You must attach current year 10% ITC Certification Letter from the Department of Labor and Training) . . .

Unused 10% Investment Tax Credit from Prior Year(s) -

Attach schedule showing Year Generated, Amount Generated, Amount(s) Used and Year(s) Used . . .

A.

Total 10% Investment Tax Credit Available . . .

4% Investment Tax Credit Calculation

Date Placed

Description of Property

Date Acquired

Life

Cost

% Qualifying

Basis for Credit

in Service

Credit Amount for 4% Investment Tax Credit . . .

Unused 4% Investment Tax Credit from Prior Year(s) -

Attach schedule showing Year Generated, Amount Generated, Amount(s) Used and Year(s) Used . . .

B.

Total 4% Investment Tax Credit Available . . .

ITC Calculation -

Note: This worksheet does not take into account other Rhode Island Credits. Refer to each credit law for proper usage order of credits.

1.

Enter Tax Amount from Form RI-1120C, line 13...................................................................................................................................

2.

Enter Minimum Tax Amount (RI-1120C - enter $500.00)......................................................................................................................

3.

Maximum ITC Amount. Subtract line 2 from line 1............................................................................................................................

4.

Enter 4% credit amount from line B above...........................................................................................................................................

4% ITC Credit Used. If line 4 is less than or equal to line 3, enter the amount from line 4 here. If line 4 is more than line 3,

5.

enter the amount from line 3 here.........................................................................................................................................................

6.

Tax Balance after 4% ITC credit usage. Subtract line 5 from line 3.................................................................................................

Multiply line 6 times 50% (0.5000) and enter here. 10% ITC is limited to half the tax amount. However, if the entity is a high

7.

performance manufacturer, enter amount from line 6. The half tax limitation does not apply to high performance manufacturers...

8.

10% ITC Credit Used. Enter the lesser of line 7 or the 10% ITC amount from line A........................................................................

9.

2012 ITC Credit. Add lines 5 and 8. Enter here and on Form RI-1120C, Schedule D, line 14A.......................................................

10. 4% ITC carryforward amount. Subtract line 5 from line B.................................................................................................................

11. 10% ITC carryforward amount. Subtract line 8 from line A...............................................................................................................

1

1 2

2