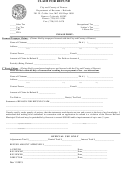

M4X page 3

2013 Amended Income Calculation

Name of corporation/designated filer

FEIN

Minnesota tax ID

You must round amounts

to nearest whole dollar.

1 Federal taxable income before net operating loss deduction and special deductions

1

(from federal Form 1120) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Additions to income

2a

a . Federal deduction taken for taxes based on net income and minimum fee . . . . . . . . . . . . . . . . . .

2b

b . Federal deduction for capital losses (IRC sections 1211 and 1212) . . . . . . . . . . . . . . . . . . . . . . .

2c

c . Interest income exempt from federal income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2d

d . Exempt interest dividends (IRC section 852[b][5]) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2e

e . Losses from mining operations subject to occupation tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f . Federal deduction for percentage depletion

2f

(IRC sections 611-614 and 291) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2g

g . Federal bonus depreciation and suspended loss (IRC section 168[k]) . . . . . . . . . . . . . . . . . . . . .

2h

h . Domestic production activities deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2i

i . Eighty percent of excess IRC section 179 deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2j

j . Fines, fees and penalties deducted federally . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2k

k . Additions due to non-conformity (see 2013 Form M4I line 2k instructions) . . . . . . . . . . . . . . . . .

2

Total additions (add lines 2a through 2k) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Total (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Subtractions from income

4a

a . Refund of taxes based on net income included in federal taxable income . . . . . . . . . . . . . . . . . .

4b

b . Minnesota deduction for capital losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c . Sum of research expenses, IRC sections 45A(a) and 51 salary expenses, disability

access expenditures, and IRC section 45G(a) railroad track maintenance expenses

4c

disallowed for federal tax purposes (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4d

d. Foreign dividend gross-up required under IRC section 78 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4e

e . Expenses relating to income taxable by Minnesota, but federally exempt . . . . . . . . . . . . . . . . . . .

4f

f . Dividends paid by a bank to the U .S . government on preferred stock . . . . . . . . . . . . . . . . . . . . . .

4g

g. Deduction for previously disallowed intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4h

h . Income/gains from mining operations subject to the occupation tax . . . . . . . . . . . . . . . . . . . . . .

4i

i . Deduction for cost depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4j

j. Minnesota depreciation for pre-1987 certified pollution control facilities . . . . . . . . . . . . . . . . . . .

4k

k . Subtraction for prior bonus depreciation addback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4l

l . Subtraction for prior IRC section 179 addback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4m

m. Subtraction for prior addback of reacquisition of indebtedness income . . . . . . . . . . . . . . . . . . . .

4n

n . Subtractions due to non-conformity (see 2013 Form M4I line 4n instructions) . . . . . . . . . . . . . .

Total subtractions from federal taxable income before net operating loss

4

deduction and special deductions (add lines 4a through 4n) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Intercompany eliminations (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Add lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 Minnesota net income (subtract line 6 from line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter this amount on M4X, page 1, line 1, column C.

9995

1

1 2

2 3

3 4

4 5

5