Instructions For Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2014 Page 2

ADVERTISEMENT

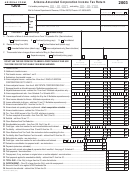

Arizona Form 120X

corporation. If this is a combined return, enter the TIN of the

Column (b): Enter the amount of any change(s). Include

corporation under which the group is filing.

any schedules, forms, and/or statements which are

necessary to fully explain and substantiate the change(s).

All returns, statements, and other documents filed with the

The amounts entered in column (b) should be the net

department require a TIN. Taxpayers that fail to include their

increase or net decrease for each line that has been

TIN may be subject to a penalty. Paid tax return preparers must

changed. Use a minus sign to indicate decreases entered

include their TIN where requested. The TIN for a paid tax return

in column (b).

preparer is the individual's social security number or the EIN of

Column (c): Add the increase in column (b) to the

the business. Paid tax return preparers that fail to include their

amount in column (a) or subtract the decrease in column

TIN may be subject to a penalty.

(b) from column (a). Enter the result here. If the line has

Line A: If the correct box

on the 2014

WAS NOT CHECKED

not been changed, enter the amount from column (a) in

Form 120, line B, indicate the correct method of filing by

column (c).

checking the appropriate box. Explain the correction on the

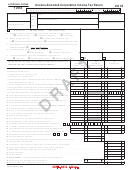

Line 9 - Apportionment Ratio

2014 Form 120X, Schedule C.

(Multistate Taxpayers Only)

If the correct box

on the 2014 Form 120,

WAS CHECKED

If the apportionment ratio is being amended, enter the

information question B: (i) do not check any boxes for line A and

amended apportionment ratio in column (c) from page 2,

(ii) answer line D, if Form 120X is being filed to change the

Schedule A, line A5, column C, or from Schedule ACA, line

Arizona method of filing.

3. If the apportionment ratio is not being amended, enter the

Line B: Check the Arizona adjustments only box if the

apportionment ratio from the 2014 Form 120, page 1, line 9,

amended return is being filed to report only state changes.

or as adjusted by any prior audit or amended return,

State

change

examples

include

adjustments

to

the

whichever is latest. The taxpayer must carry out the ratio on

apportionment ratio and adjustments to either additions to or

line 9 to six places.

subtractions from federal taxable income.

Refer to the Schedule ACA or Schedule A instructions for

Line C: If this amended return is filed to incorporate a capital

more information. Do not enter an amount on page 1, line 9,

loss carryback, check the box and enter the last day (month,

before reading the Schedule ACA or Schedule A instructions.

day and year) of the tax year the capital loss originated.

Line 16 - Arizona Tax

Line D: If this amended return is filed to change the Arizona

method of filing, check the appropriate box. Complete the

Multiply Arizona taxable income [line 15, column (c)] by

Form 120X, Schedule C, to explain the changes. Include a

6.5%. If the computed amount of tax is less than $50, enter

completed Form 51 with Form 120X.

the minimum tax of $50. Every corporation required to file a

return shall pay a $50 minimum tax in accordance with

Line E: If this amended return includes changes to the

Arizona Revised Statutes (A.R.S.) § 43-1111.

Arizona apportionment ratio, check the appropriate box.

Complete Form 120X, Schedule A, (or include a revised

Combined or consolidated returns - a unitary group or an

Schedule ACA, if applicable) and explain the changes on

Arizona affiliated group is considered a single taxpayer. The

Schedule C.

minimum tax is imposed on the single taxpayer rather than on

each corporation within the group.

Line F: Check the box on line F if the election to be treated

as a multistate service provider was made on your original

Line 17 - Tax from Recapture of Tax Credits

return.

Enter the amount of tax due from recapture tax credits from

Arizona Form 300, Part 2, line 31.

NOTE to Line F: The multistate service provider election as

prescribed in the Arizona Revised Statutes (A.R.S.) §43-

Line 18 - Subtotal

1147(B) must be made on the taxpayer’s timely filed original

Add lines 16 and 17. This is the amount of tax to which the

tax return including extensions. This election is binding for

total amount of tax credits claimed by the taxpayer may be

five consecutive taxable years. Taxpayers cannot make the

used.

election or revoke the election by amending the tax return.

See A.R.S. §43-1147 and Schedule MSP for more

Line 19 - Nonrefundable Tax Credits

information.

Enter the allowable nonrefundable tax credit amount from

Arizona Form 300, Part 2, line 56. This amount cannot be

Lines 1 through 8, lines 10 through 19, and line 21 -

larger than the amount on Form 120X, line 18.

NOTE: Columns (a) and (c) must be completed for each line

Enterprise Zone Credit. The enterprise zone credit has

whether or not a change has been made to a particular line.

been repealed. The repeal did not affect carryforwards

Enter an amount in column (b) only if a change has been

of properly established credits. See Form 304 for more

made for a particular line.

information.

Column (a): Enter the amounts as shown on the original

Environmental Technology Facility Credit. This tax

return or as adjusted by any prior audit, amended return,

credit is for costs incurred in constructing a qualified

or Department of Revenue correction notice, whichever

environmental technology manufacturing, producing, or

is latest.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7