Instructions For Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2014 Page 6

ADVERTISEMENT

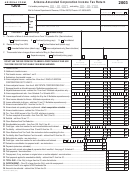

Arizona Form 120X

The taxpayer must be engaged in air commerce. “Air

NOTE: The multistate service provider election as

commerce” means transporting persons or property for hire

prescribed in the Arizona Revised Statutes (A.R.S.) §43-

by

aircraft

in

interstate,

intrastate

or

international

1147(B) must be made on the taxpayer’s timely filed original

transportation. If the taxpayer files a combined or

tax return including extensions. This election is binding for

consolidated return, the combined group or the Arizona

five consecutive taxable years. Taxpayers cannot make the

affiliated group must use this method of apportionment if

election or revoke the election by amending the tax return.

50% or more of the taxpayer’s gross income is derived from

See A.R.S. §43-1147 and Schedule MSP for more

air commerce. The taxpayer will apportion its business

information.

income by means of a single apportionment ratio computed

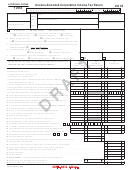

Line A5 - Average Apportionment Ratio

under this method for all group members.

Divide the total ratio, line A4, column C, by four. Enter the

Schedule A – Apportionment Formula

average ratio amount here and on page 1, line 9, column (c).

(Non-Air Carrier Multistate Taxpayers Only)

Express the ratio as a decimal carried out to six places.

Schedule A must be completed only if the 2014 Form 120X

NOTE: The taxpayer must exclude a factor if both the

is filed to amend the apportionment ratio (if the taxpayer was

numerator and the denominator of a factor are zero. Do not

required to use Schedule A). If the apportionment ratio is not

exclude a factor from the total ratio (line A4, column C) if the

being amended, enter the apportionment ratio from the 2014

numerator of a factor is zero and the denominator of a factor

Form 120 or as adjusted by any prior audit or amended

is greater than zero. If the property or payroll factor is

return, whichever is latest, on the Form 120X, page 1, line 9,

excluded, determine the average ratio (line A5, column C) by

in column (a) and column (c).

dividing the total ratio by three. If the sales factor is

excluded, determine the average ratio by dividing the total

A.R.S. § 43-1139 (Allocation of business income) provides

ratio by two. If two of the factors are excluded, the remaining

that the apportionment ratio is a fraction. Non-air carrier

factor, without respect to any weighting, is the apportionment

taxpayers may choose either the standard apportionment

ratio.

formula (option 1) or the enhanced apportionment formula

(option 2). For the standard apportionment formula, the

Option 2: Enhanced Apportionment Formula

numerator of the fraction is the property factor plus the

payroll factor plus two times the sales factor. The

Line A1e -

denominator of the fraction is four. For the enhanced

Compute the property factor numerator by multiplying the

apportionment formula, the numerator of the fraction is 7.5

times the property factor plus 7.5 times the payroll factors

total amount of Arizona property (line A1c, column A) by

plus 85 times the sales factor. The denominator of the

7.5. Do not multiply the property factor denominator by 7.5.

fraction is 100.

Next, for line A1e, divide column A by column B and enter

the resulting ratio in column C. Express the ratio as a decimal

When computing the factors of the apportionment ratio,

carried out to six places. The property factor on line A1e,

round amounts to the nearest whole dollar. If 50 cents or

column C, may exceed 100 percent.

more, round up to the next dollar. If less than 50 cents, round

down.

Line A2c -

NOTE: For the detailed instructions with respect to the

Compute the payroll factor numerator by multiplying the total

standard

apportionment

formula

or

the

enhanced

amount of Arizona payroll (line A2a, column A) by 7.5. Do

apportionment formula, see the instructions for 2014 Form

not multiply the payroll factor denominator by 7.5. Next, for

120.

line A2c, divide column A by column B and enter the

resulting ratio in column C. Express the ratio as a decimal

Option 1: Standard Apportionment Formula

carried out to six places. The property factor on line A2c,

Line A3f -

column C, may exceed 100 percent.

Line A3f -

NOTE: Multiply the amount entered on line A3d, column A,

the total Arizona sales, by two (double weighted sales factor)

NOTE: Multiply the amount entered on line A3d, column A,

on line A3e, column A. Enter the result on line A3f, column A.

the total Arizona sales, by 85 on line A3e, column A. Enter

Do not double the amount entered on line A3d, column B, the

the result on line A3f, column A. Do not multiply the amount

everywhere sales of the taxpayer.

entered on line A3d, column B, the everywhere sales of the

EXAMPLE: The taxpayer has total Arizona sales of $100,000

taxpayer, by 85.

(on line A3d, column A) and total everywhere sales of

EXAMPLE: The taxpayer has total Arizona sales of $100,000

$1,000,000 (on line A3d, column B). On line A3f, column A,

(on line A3d, column A) and total everywhere sales of

enter $200,000 of Arizona sales. On line A3f, column B, enter

$1,000,000 (on line A3d, column B). On line A3f, column A,

$1,000,000 of everywhere sales for the taxpayer.

enter $8,500,000 of Arizona sales. On line A3f, column B,

The sales factor ratio in column C of line A3f may, in certain

enter $1,000,000 of everywhere sales for the taxpayer.

circumstances, exceed 100 percent. However, since the total

The sales factor ratio in column C of line A3f may, in certain

ratio (line A4) is divided by four, the average ratio (line A5)

circumstances, exceed 100 percent. However, since the total

will not exceed 100 percent.

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7