Instructions For Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2014 Page 7

ADVERTISEMENT

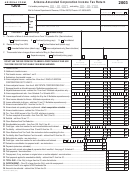

Arizona Form 120X

ratio (line A4) is divided by 100, the average ratio (line C5)

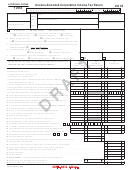

Schedule C – Explanation of Changes

will not exceed 100 percent.

Explain the changes made in this return. If additional space is

NOTE: The multistate service provider election as

needed, prepare a schedule (in the same format) labeled

prescribed in the Arizona Revised Statutes (A.R.S.) §43-

“Schedule C – Explanation of Changes” and include the

1147(B) must be made on the taxpayer’s timely filed original

schedule with the Form 120X. Include any necessary

tax return including extensions. This election is binding for

supporting documentation with the return.

five consecutive taxable years. Taxpayers cannot make the

election or revoke the election by amending the tax return.

Certification

See A.R.S. §43-1147 and Schedule MSP for more

One or more of the following officers (president, treasurer, or

information.

any other principal officer) must sign the return.

Line A5 - Average Apportionment Ratio

Paid preparers: Sign and date the return. Complete the firm

Divide the total ratio, line A4, column C, by 100. Enter the

name and address lines (the paid preparer’s name and

average ratio amount here and on page 1, line 9, column (c).

address, if self-employed). Enter the paid preparer’s TIN,

Express the ratio as a decimal carried out to six places.

which is the firm’s EIN or the individual preparer’s social

security number.

NOTE: The taxpayer must exclude a factor if both the

numerator and the denominator of a factor are zero. Do not

Interest

exclude a factor from the total ratio (line A4, column C) if the

The department will calculate any interest due and will either

numerator of a factor is zero and the denominator of a factor

include it in the refund or bill the taxpayer for the interest.

is greater than zero. If the property or payroll factor is

excluded, determine the average ratio (line A5, column C) by

Obtain information and current interest rates by contacting

dividing the total ratio by 92.5. If the sales factor is excluded,

one of the numbers listed on page 1 of these instructions.

determine the average ratio by dividing the total ratio by 15.

Interest rate tables are also available on the department’s

If two of the factors are excluded, the remaining factor,

website at the address listed on page 1 of these instructions.

without respect to any weighting, is the apportionment ratio.

Schedule B – Schedule of Payments

List the payment sent with the original return and all payments

made by the taxpayer after the original return was filed.

If additional space is required to list all of the payments,

prepare a schedule (in the same format) labeled “Schedule B –

Schedule of Payments” and include the schedule with the Form

120X.

DO NOT include the claim of right credit computed under

A.R.S. § 43-1130.01 in this schedule.

DO NOT include amounts paid for penalties and interest or

payments reported on page 1, line 23.

Enter the total on Schedule B, line B4, and on page 1, line 24.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7