Instructions For Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2014 Page 5

ADVERTISEMENT

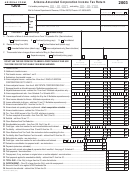

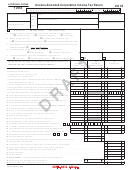

Arizona Form 120X

Line 23 - Payments (Extension, Estimated)

Electronic payment from checking or savings account

Payments can be made electronically from a checking or

Enter the total amount from the original return (2014 Form 120,

savings account. Go to and choose the

lines 23 and 24; or 2014 Form 120A, lines 15 and 16).

e-check option. There is no fee to use this method. This

Line 24 - Payment with Original Return (Plus All

payment method will debit the amount from the specified

Payments After It Was Filed)

checking or savings account on the date specified. If an

electronic payment is made from a checking or savings

Enter the amount from page 2, Schedule B, line B4.

account, a confirmation number will be generated. Please

Line 25 - Total Payments

keep this confirmation number as proof of payment.

Add lines 22, 23 and 24. Enter the total.

Credit card payment

NOTE FOR CLAIM OF RIGHT RESTORATION: If the

Payments can be made via American Express, Discover,

tax for the taxable year 2014 was computed under the

MasterCard or VISA credit cards. Go to

provisions for a claim of right restoration, line 25 also

and choose the credit card option. This will take you to the

includes the credit for the tax reduction for prior taxable

website of the credit card payment service provider. The

year(s). Refer to Arizona Corporate Income Tax Procedure

service provider will charge a convenience fee based on the

CTP

95-3

for

further

information.

Write

"A.R.S.

amount of the tax payment. The service provider will disclose

§ 43-1130.01" and the total amount of the tax reduction for

the amount of the convenience fee during the transaction and

prior taxable year(s) in the space to the left of the total

the option to continue or cancel the transaction will be

payment amount entered on line 25. The amount entered on

presented. If you accept the convenience fee and complete the

line 25 is the total of lines 22, 23 and 24 and the tax

credit card transaction, a confirmation number will be

reduction for prior taxable year(s). Include a schedule

generated. Please keep this confirmation number as proof of

computing the tax reduction for the prior taxable year(s).

payment.

Line 31 - Overpayment

Line 26 - Overpayment from Original Return or as

Later Adjusted

If line 27 is larger than line 21, column (c), enter the

difference. This amount is the overpayment from this

Enter the amount of any overpayment of tax from the original

amended return.

return (2014 Form 120, line 31; or 2014 Form 120A, line 23),

Line 32 - Amount to be Applied to 2015 Estimated

and the total amount of any overpayments of tax from a

Department of Revenue correction notice, a previously filed

Taxes

amended return (2014 Form 120X, line 31), or an audit.

The taxpayer may apply part or all of an overpayment

reported on line 31 as a 2015 estimated tax payment, if this

Line 28 - Total Due

amended return is filed during the taxpayer's taxable year

If line 21, column (c) is larger than line 27, enter the

2015. Enter the applicable amount on line 32. If the taxpayer

difference. This is the amount of tax due.

wants the entire line 31 amount to be refunded, enter zero.

Line 29 - Penalty and Interest

Line 33 - Amount to be Refunded

Calculate any penalty and interest due. Calculate interest on

Subtract line 32 from line 31, and enter the difference. This is

the amount shown on line 28 at the prevailing rate. The

the net refund amount.

interest period is from the original due date of the return to

Schedule ACA – Air Carrier Apportionment

the payment date, and is compounded annually.

Formula

Line 30 - Payment Due

(Multistate Air Carriers Only)

Add lines 28 and 29, and enter the total here. This is the

Schedule ACA must be completed and included only if the

amount of payment due. Non-EFT payment must be included

2014 Form 120X is filed to amend the apportionment ratio.

with the amended return. Payments can be made via check,

The taxpayer must complete Schedule ACA to amend the

electronic check, money order, or credit card.

apportionment ratio originally computed on Schedule ACA

Check or Money Order

or if the taxpayer incorrectly used the Form 120, Schedule E,

Make checks payable to Arizona Department of Revenue.

rather than Schedule ACA to compute the apportionment

Include the taxpayer's EIN on the front of the check or money

ratio. Schedule ACA is available on the department's website:

order. Include the check or money order with the return.

If

the

apportionment ratio is not being amended, enter the

Internet Payments

apportionment ratio from the 2014 Form 120 or as adjusted

Corporate taxpayers must be licensed by the department

by any prior audit or amended return, whichever is latest, on

before they can register to pay taxes online. Go to

the Form 120X, page 1, line 9, in column (a) and column (c).

to register and make payments over the

A.R.S. § 43-1139 requires a taxpayer that is a qualifying air

internet.

carrier to use an alternate apportionment method to apportion

its business income to Arizona.

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7