Form Rev-414(F) Ex - Estates And Trusts Worksheet

ADVERTISEMENT

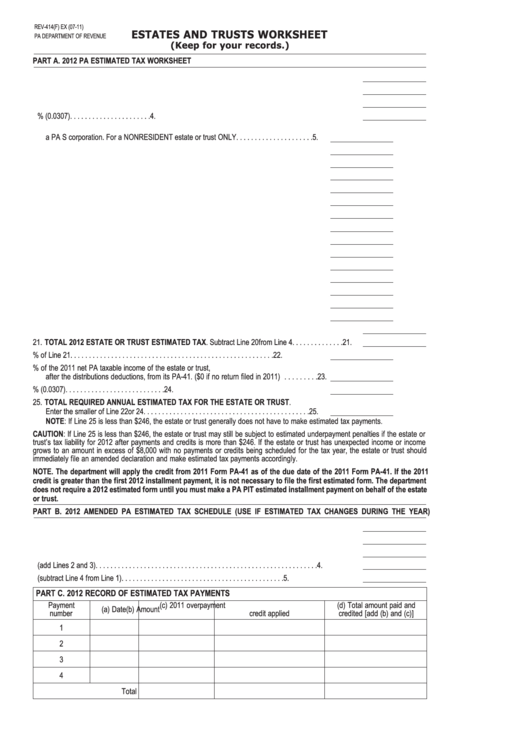

REV-414(F) EX (07-11)

ESTATES AND TRUSTS WORKSHEET

PA DEPARTMENT OF REVENUE

(Keep for your records.)

PART A. 2012 PA ESTIMATED TAX WORKSHEET

1. Enter the expected 2012 PA taxable income for the estate or trust. . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Estimated 2012 deductions for distributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Estimated 2012 PA taxable estate or trust income. Subtract Line 2 from Line 1. . . . . . . . . . . . . . . . . . 3.

4. Estimated 2012 PA estate or trust tax. Multiply Line 3 by 3.07% (0.0307). . . . . . . . . . . . . . . . . . . . . . 4.

5. Estimated Nonresident Tax Withheld if the estate or trust is a shareholder in

a PA S corporation. For a NONRESIDENT estate or trust ONLY. . . . . . . . . . . . . . . . . . . . . 5.

6. Estimated Credit for Income Tax Paid to Other States. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Estimated PA Employment Incentive Payment Credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Estimated PA Job Creation Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Estimated PA Research and Development Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Estimated PA Film Production Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Estimated PA Organ and Bone Marrow Donor Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Estimated PA Keystone Innovation Zone Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Estimated PA Resource Enhancement and Protection Tax Credit. . . . . . . . . . . . . . . . . . . . 13.

14. Estimated PA Neighborhood Assistance Program Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Estimated PA Strategic Development Area Job Creation Tax Credit. . . . . . . . . . . . . . . . . . . 15.

16. Estimated PA Educational Improvement Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. Estimated PA Keystone Special Development Zone Tax Credit. . . . . . . . . . . . . . . . . . . . . . 17.

18. Other PA Schedule OC Credit not listed above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

19. Estimated Other PA Tax Withheld. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

20. Total Estimated Credits. Add Lines 5 through 19. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

21. TOTAL 2012 ESTATE OR TRUST ESTIMATED TAX. Subtract Line 20 from Line 4. . . . . . . . . . . . . . 21.

22. Enter 90% of Line 21. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.

23. Enter 100% of the 2011 net PA taxable income of the estate or trust,

after the distributions deductions, from its PA-41. ($0 if no return filed in 2011) . . . . . . . . . 23.

24. Figure the tax by multiplying Line 23 by 3.07% (0.0307). . . . . . . . . . . . . . . . . . . . . . . . . . . 24.

25. TOTAL REQUIRED ANNUAL ESTIMATED TAX FOR THE ESTATE OR TRUST.

Enter the smaller of Line 22 or 24. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.

NOTE: If Line 25 is less than $246, the estate or trust generally does not have to make estimated tax payments.

CAUTION: If Line 25 is less than $246, the estate or trust may still be subject to estimated underpayment penalties if the estate or

trust’s tax liability for 2012 after payments and credits is more than $246. If the estate or trust has unexpected income or income

grows to an amount in excess of $8,000 with no payments or credits being scheduled for the tax year, the estate or trust should

immediately file an amended declaration and make estimated tax payments accordingly.

NOTE. The department will apply the credit from 2011 Form PA-41 as of the due date of the 2011 Form PA-41. If the 2011

credit is greater than the first 2012 installment payment, it is not necessary to file the first estimated form. The department

does not require a 2012 estimated form until you must make a PA PIT estimated installment payment on behalf of the estate

or trust.

PART B. 2012 AMENDED PA ESTIMATED TAX SCHEDULE (USE IF ESTIMATED TAX CHANGES DURING THE YEAR)

1. Amended estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Amount of 2011 overpayment applied to 2012 estimated tax and payments to date. . . . . . . . . . . . . . 2.

3. Estimated tax payments to date. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Total (add Lines 2 and 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Unpaid balance (subtract Line 4 from Line 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

PART C. 2012 RECORD OF ESTIMATED TAX PAYMENTS

Payment

(c) 2011 overpayment

(d) Total amount paid and

(a) Date

(b) Amount

number

credit applied

credited [add (b) and (c)]

1

2

3

4

Total

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2