Form Rev-413(F) Ex - Instructions For Estimating Pa Fiduciary Income Tax For (Estates And Trusts Only)

ADVERTISEMENT

REV-413(F) EX (04-12)

INSTRUCTIONS FOR ESTIMATING

PA DEPARTMENT OF REVENUE

PA FIDUCIARY INCOME TAX FOR (ESTATES AND TRUSTS ONLY)

PART 1. WHO MUST MAKE ESTIMATED TAX PAYMENTS

Part A and Part B of Form REV-414(F) will help you figure the correct

amount to pay. Use the Record of Estimated Tax Payments on Form

Fiduciaries of estates and trusts must make PA estimated tax

REV-414(F) to keep track of the payments made and amount of the

payments if they reasonably expect that the estate or trust will earn,

receive, or realize income of $8,000 ($246 in tax) for 2012, and they

remaining payments. Use Forms PA-40ES Fiduciary or PA-40ESR

reasonably expect the credits will be less than the smaller of:

(F/C); Declaration of Estimated Personal Income Tax forms to

ensure the department properly credits the estimated tax installment

• 90 percent of the tax to be shown on the estate or trust’s 2012

payments.

tax return; or

• 100 percent of the product of multiplying the net PA taxable

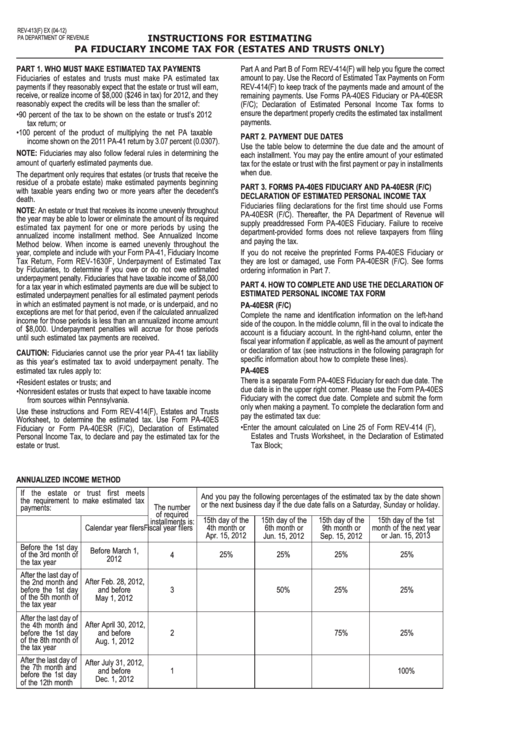

PART 2. PAYMENT DUE DATES

income shown on the 2011 PA-41 return by 3.07 percent (0.0307).

Use the table below to determine the due date and the amount of

NOTE: Fiduciaries may also follow federal rules in determining the

each installment. You may pay the entire amount of your estimated

amount of quarterly estimated payments due.

tax for the estate or trust with the first payment or pay in installments

when due.

The department only requires that estates (or trusts that receive the

residue of a probate estate) make estimated payments beginning

PART 3. FORMS PA-40ES FIDUCIARY AND PA-40ESR (F/C)

with taxable years ending two or more years after the decedent's

DECLARATION OF ESTIMATED PERSONAL INCOME TAX

death.

Fiduciaries filing declarations for the first time should use Forms

NOTE: An estate or trust that receives its income unevenly throughout

PA-40ESR (F/C). Thereafter, the PA Department of Revenue will

the year may be able to lower or eliminate the amount of its required

supply preaddressed Form PA-40ES Fiduciary. Failure to receive

estimated tax payment for one or more periods by using the

department-provided forms does not relieve taxpayers from filing

annualized income installment method. See Annualized Income

and paying the tax.

Method below. When income is earned unevenly throughout the

year, complete and include with your Form PA-41, Fiduciary Income

If you do not receive the preprinted Forms PA-40ES Fiduciary or

Tax Return, Form REV-1630F, Underpayment of Estimated Tax

they are lost or damaged, use Form PA-40ESR (F/C). See forms

by Fiduciaries, to determine if you owe or do not owe estimated

ordering information in Part 7.

underpayment penalty. Fiduciaries that have taxable income of $8,000

PART 4. HOW TO COMPLETE AND USE THE DECLARATION OF

for a tax year in which estimated payments are due will be subject to

ESTIMATED PERSONAL INCOME TAX FORM

estimated underpayment penalties for all estimated payment periods

PA-40ESR (F/C)

in which an estimated payment is not made, or is underpaid, and no

exceptions are met for that period, even if the calculated annualized

Complete the name and identification information on the left-hand

income for those periods is less than an annualized income amount

side of the coupon. In the middle column, fill in the oval to indicate the

of $8,000. Underpayment penalties will accrue for those periods

account is a fiduciary account. In the right-hand column, enter the

until such estimated tax payments are received.

fiscal year information if applicable, as well as the amount of payment

CAUTION: Fiduciaries cannot use the prior year PA-41 tax liability

or declaration of tax (see instructions in the following paragraph for

specific information about how to complete these lines).

as this year’s estimated tax to avoid underpayment penalty. The

PA-40ES

estimated tax rules apply to:

There is a separate Form PA-40ES Fiduciary for each due date. The

• Resident estates or trusts; and

due date is in the upper right corner. Please use the Form PA-40ES

• Nonresident estates or trusts that expect to have taxable income

Fiduciary with the correct due date. Complete and submit the form

from sources within Pennsylvania.

only when making a payment. To complete the declaration form and

Use these instructions and Form REV-414(F), Estates and Trusts

pay the estimated tax due:

Worksheet, to determine the estimated tax. Use Form PA-40ES

• Enter the amount calculated on Line 25 of Form REV-414 (F),

Fiduciary or Form PA-40ESR (F/C), Declaration of Estimated

Personal Income Tax, to declare and pay the estimated tax for the

Estates and Trusts Worksheet, in the Declaration of Estimated

estate or trust.

Tax Block;

ANNUALIZED INCOME METHOD

If the estate or trust first meets

And you pay the following percentages of the estimated tax by the date shown

the requirement to make estimated tax

or the next business day if the due date falls on a Saturday, Sunday or holiday.

The number

payments:

of required

15th day of the

15th day of the 1st

15th day of the

15th day of the

installments is:

4th month or

month of the next year

Fiscal year filers

Calendar year filers

6th month or

9th month or

Apr. 15, 2012

or Jan. 15, 2013

Jun. 15, 2012

Sep. 15, 2012

Before the 1st day

Before March 1,

of the 3rd month of

4

25%

25%

25%

25%

2012

the tax year

After the last day of

After Feb. 28, 2012,

the 2nd month and

before the 1st day

and before

3

50%

25%

25%

of the 5th month of

May 1, 2012

the tax year

After the last day of

After April 30, 2012,

the 4th month and

before the 1st day

and before

2

75%

25%

of the 8th month of

Aug. 1, 2012

the tax year

After the last day of

After July 31, 2012,

the 7th month and

and before

1

100%

before the 1st day

Dec. 1, 2012

of the 12th month

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2