Form Rev-413(I) Ex - Instructions For Estimating Pa Personal Income Tax (For Individuals Only)

ADVERTISEMENT

REV-413(I) EX (04-12)

INSTRUCTIONS FOR ESTIMATING

PA DEPARTMENT OF REVENUE

PA PERSONAL INCOME TAX (FOR INDIVIDUALS ONLY)

Estimated tax is the method used to pay tax on income that is not

Tax, to declare and pay your estimated tax and credit your estimated

subject to withholding such as:

tax to your account properly.

Part A and Part B of Form REV-414(I) will help you figure the correct

• Wages for domestic service;

amount to pay. Use the Record of Estimated Tax Payments on Form

• Tips received from customers;

REV-414(I) to keep track of the payments you have made and the

• Wages paid to residents who are seamen engaged in interstate

amount of your remaining payments.

or intercoastal trade or who work in Indiana, Maryland, New

Jersey, Ohio, Virginia and West Virginia when PA income tax is

PART 2. JOINT DECLARATION

not withheld by the employer;

A husband and wife may file a joint return declaration, unless:

• Earnings from self-employment or profits made in a trade,

1. They are separated under a decree of divorce or separate

profession, business or farming;

maintenance;

• Gains from the sale, exchange or disposition of property;

2. They have different taxable years;

• Interest and dividends;

3. One spouse is liable for child support;

• Rents and royalties;

4. One spouse claims one or more credits on PA Schedule OC; or

• Gambling and lottery winnings (except PA Lottery winnings); and

5. One spouse is otherwise required by the department to file a

• Income derived from estates and trusts.

separate return. See the PA-40 Instruction Booklet for

PART 1. WHO MUST MAKE ESTIMATED TAX PAYMENTS

Married, Filing Separately filing status for details on who must

file separate returns.

The estimated tax rules apply to:

To avoid problems and delays in processing your income tax return,

• Residents and part-year residents of Pennsylvania; and

a husband and wife should file tax returns in the same manner as they

• Nonresidents of Pennsylvania (or residents of other countries)

made their estimated installment payments. If you and your spouse

who expect to have taxable income from sources within

made joint estimated payments, file a joint return. If you and your

Pennsylvania.

spouse made separate estimated payments, please file separate

Except for farmers as explained below, you must make PA estimated

returns claiming the proper amounts on each return. If you and your

tax payments if:

spouse need to file differently from the way you submitted your

estimated payments, complete Form REV-459B, Consent to

1. You reasonably expect, after subtracting your withholding and

Transfer, Adjust or Correct PA Estimated Personal Income Tax

credits, that you would owe at least $246 ($8,000 of income not

Account, to adjust the estimated accounts.

subject to employer withholding) in tax for 2012, and

PART 3. PAYMENT DUE DATES

2. You can reasonably expect your withholdings and allowable

credits to be less than the smaller of:

Use the following table to determine the due date and the amount of

each installment. You may pay all of your estimated tax with your first

• Ninety percent of the tax to be shown on your 2012 tax return;

payment or pay in installments when due. You may elect to apply

or

your overpayment from your 2011 PA tax return against your 2012

• The product of multiplying the PA taxable income shown on your

estimated tax liability. If so, the department will apply your approved

2011 PA tax return by 3.07 percent (0.0307). This calculation

overpayment to the first installment, unless you notify the PA

can be used only by taxpayers who were full-year PA residents

Department of Revenue in writing to apply your overpayment to

in 2011.

another installment. When income is earned unevenly throughout the

Example: You expect your 2012 tax liability to be $20,000. Ninety

year, complete Form REV-1630, Underpayment of Estimated Tax by

percent of this amount is $18,000. You were a full-year resident in

Individuals, to determine if you owe estimated underpayment penalty.

2011, and your 2011 PA taxable income times the 2012 tax rate of

FARMERS

3.07 percent is $16,000. If you reasonably expect your amount of

2012 tax withheld and other allowable credits to be less than

If at least two-thirds of your gross income for 2012 is from farming,

$16,000, you must make estimated payments. This is because you

you may do one of the following:

would owe more than $246 after subtracting your expected withhold-

• Pay all of your estimated tax by Jan. 15, 2013; or

ings and credits; your expected withholdings and credits would be

• File your 2012 PA tax return by March 1, 2013 and pay the total

less than 90 percent of your 2012 tax liability; and your expected

withholdings and credits are less than your 2011 taxable income

tax due. In this case, 2012 estimated tax payments are not

times the expected 2012 tax rate of 3.07 percent.

required.

CAUTION

PART 4. HOW TO COMPLETE AND USE THE DECLARATION OF

ESTIMATED PERSONAL INCOME TAX FORM

A taxpayer cannot use the prior year’s tax liability as this year’s

estimated tax to avoid underpayment penalty.

Individuals filing declarations for the first time should use Forms

Use these instructions and Form REV-414(I), Individuals

PA-40ESR(I). Thereafter, the PA Department of Revenue will supply

Worksheet, to determine your estimated tax. Use Form PA-40ES(I)

preprinted Forms PA-40ES(I). Failure to receive department-provided

or Form PA-40ESR(I), Declaration of Estimated Personal Income

forms does not relieve taxpayers from filing and paying the tax.

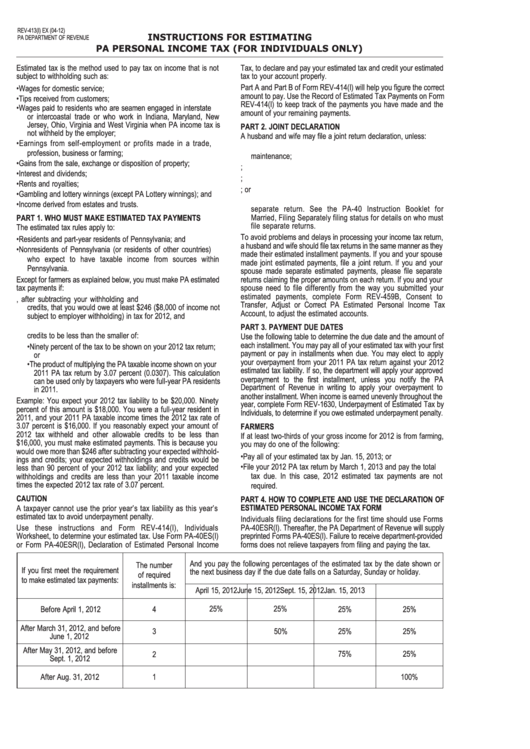

And you pay the following percentages of the estimated tax by the date shown or

The number

If you first meet the requirement

the next business day if the due date falls on a Saturday, Sunday or holiday.

of required

to make estimated tax payments:

installments is:

April 15, 2012

June 15, 2012

Sept. 15, 2012

Jan. 15, 2013

Before April 1, 2012

4

25%

25%

25%

25%

After March 31, 2012, and before

3

50%

25%

25%

June 1, 2012

After May 31, 2012, and before

2

75%

25%

Sept. 1, 2012

After Aug. 31, 2012

1

100%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2