*130145==29999*

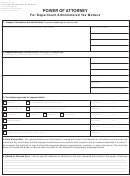

Period

Period

(MM/DD/YY-MM/DD/YY)

(MM/DD/YY-MM/DD/YY)

–

–

State Sales Tax

Partnership Income Tax

Period

Period

(MM/DD/YY-MM/DD/YY)

(MM/DD/YY-MM/DD/YY)

–

–

State Consumer Use Tax

Withholding Income Tax

Period

Period

(MM/DD/YY-MM/DD/YY)

(MM/DD/YY-MM/DD/YY)

All Department-

Individual Income Tax

–

–

Administered Sales Taxes

Period

Period

(MM/DD/YY-MM/DD/YY)

(MM/DD/YY-MM/DD/YY)

All Department-

Corporate Income Tax

–

–

Administered Consumer Use Taxes

Period

Period

(MM/DD/YY-MM/DD/YY)

(MM/DD/YY-MM/DD/YY)

–

–

Fiduciary Income Tax

Other tax (specify)

If other, please explain

Signature of Taxpayer(s)

I acknowledge the following provision: Actions taken by a Power of Attorney representative are binding,

even if the representative is not an attorney. Proceedings cannot later be declared legally defective

because the representative was not an attorney.

Corporate officers, partners, fiduciaries, or other qualified persons signing on behalf of the taxpayer(s):

I am authorized to sign this form on behalf of the entity or person identified above as the taxpayer because:

• I am the taxpayer

• The taxpayer is a corporation, and I am the corporate officer

• The taxpayer is a partnership, and I am a partner

• The taxpayer is a trust, and I am the trustee

• The taxpayer is a decedent’s estate, and I am the estate administrator

• The taxpayer is a receivership, and I am the receiver

• Other (if none of the above, then explain what representative capacity you have for the taxpayer)

If a tax matter concerns a joint return, both spouses must sign if joint representation is requested. Taxpayers

filing jointly may authorize separate representatives.

Signature

Print Name

Date

(MM/DD/YY)

Title (if applicable)

Daytime telephone number

(

)

Spouse Signature (if joint representation)

Print Name

Date

(MM/DD/YY)

Declaration of Representative — I am authorized to represent the taxpayer(s) identified above for the

tax matter(s) specified.

Signature

Date

Title

(MM/DD/YY)

Note: This authorization form automatically revokes and replaces all earlier tax information designations and/or earlier powers of

attorney for representation on file with the Colorado Department of Revenue for the same tax matters and years or periods covered

by this form. Attach a copy of any other tax information authorization or power of attorney you want to remain in effect.

If you do not want to revoke a prior authorization, taxpayer sign here

Spouse signature if returns are filed jointly

Please complete the following, if known (for routing purposes only). Otherwise, you may mail this document or submit

an electronically scanned copy of the document through Revenue Online,

Revenue Employee

Division

Section

Telephone Number

Fax Number

(

)

(

)

Send to: Colorado Department of Revenue Denver, CO 80261-0009

If this tax information authorization or power of attorney form is not signed, it will be returned.

1

1 2

2 3

3