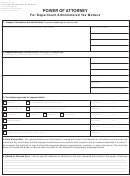

Instructions for DR 0145

This form is used for two purposes:

Unless the appointed representative has a fiduciary

Tax information disclosure authorization. You authorize

relationship to the taxpayer (for example, personal

the department to disclose your confidential tax

representative, trustee, guardian, conservator), an original

information to another person. This person will not

Notice of Deficiency will be mailed to the taxpayer as

receive original notices we send to you.

required by law. A copy will be provided to the appointed

Power of attorney for representation. You authorize

representative when requested.

another person to represent you and act on your behalf.

The person must meet the qualifications listed here.

For corporations, “taxpayer” as used on this form, must be

Unless you specify differently, this person will have

the corporation that is subject to Colorado tax. List fiscal

full power to do all things you might do, with as much

years by year end date.

binding effect, including, but not limited to: providing

information; preparing, signing, executing, filing, and

An individual who prepares and either signs your tax

inspecting returns and reports; and executing statute of

return or who is not required to sign your tax return (by

limitation extensions and closing agreements.

the instructions or by rule), may represent you during an

audit of that return. That individual may not represent

SSN: Social Security Number

you for any other purpose unless they meet one of the

CAN: Colorado Account Number

qualifications listed above.

FEIN: Federal Employer Identification Number

Generally, declarations for representation in cases

This form is effective on the date signed. Authorization

appealed beyond the Department of Revenue must be

terminates when the department receives written

in writing to the local jurisdiction district court. A person

revocation notice or a new form is executed (unless the

recognized by a district court will be recognized as your

space provided on the front is initialed indicating that prior

representative by the department.

forms are still valid). If this tax information designation

and power of attorney for representation form is used for

taxpayers on a joint return, both the primary taxpayer and

spouse must sign this form.

Taxpayer Assistance

General tax information

Revenue Online account access

Telephone

303-238-7378

1

1 2

2 3

3