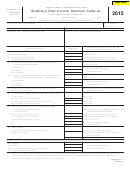

2015 Schedule 3K-1

Partner's Name

ID Number

Page 2 of 6

Partner’s state of residence (if a full-year Wisconsin resident, items G, H, and I do not apply). . . . . . . . . . . . . . . . .

F

G

Check if partner’s Wisconsin amount is determined by apportionment. Apportionment percentage . . . . . . . . .

.

%

H

Check if partner’s Wisconsin amount is determined by separate accounting.

Check if the partner is a nonresident and filed Form PW-2 to opt out of pass-through entity withholding.

I

Part III Partner

s Share of Current Year Income, Deductions, Credits, and Other Items

’

(a)

(b)

(c)

(d)

(e)

Amount under

Wis. source amount

Distributive share items

Federal amount

Adjustment

Wis. law

(see instructions)

.00

.00

1

Ordinary business income (loss) . . . . . . . . . . . . . . .

1

1

.00

.00

.00

.00

.00

.00

2

Net rental real estate income (loss) . . . . . . . . . . . . . .

2

2

.00

.00

.00

.00

3

3

Other net rental income (loss) . . . . . . . . . . . . . . . . . .

3

.00

.00

4

.00

.00

4

Guaranteed payments . . . . . . . . . . . . . . . . . . . . . . . .

4

.00

.00

.00

.00

5

5

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.00

.00

.00

.00

6

Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

.00

.00

7

Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7

.00

.00

.00

.00

8

Net short-term capital gain (loss) . . . . . . . . . . . . . . . .

8

.00

.00

8

9

Net long-term capital gain (loss) . . . . . . . . . . . . . . . .

9

.00

.00

.00

.00

9

.00

.00

10a

Net section 1231 gain (loss) . . . . . . . . . . . . . . . . . . . 10a

.00

.00

10a

10b Portion of the amount on line 10a attributable to

.00

.00

gains on sales of farm assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10b

11

Other income (loss) (list):

.00

.00

.00

.00

a

11a

11a

.00

.00

.00

.00

b

11b

11b

.00

.00

c

Total (add lines 11a and 11b) . . . . . . . . . . . . . . . . . . . 11c

.00

.00

11c

.00

.00

.00

.00

12

Section 179 deduction . . . . . . . . . . . . . . . . . . . . . . . . 12

12

Go to Page 3

1

1 2

2 3

3 4

4 5

5 6

6