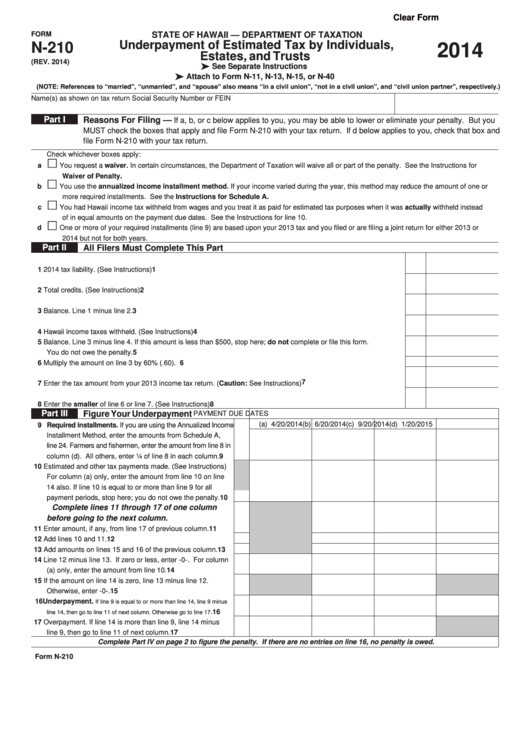

Clear Form

FORM

STATE OF HAWAII — DEPARTMENT OF TAXATION

Underpayment of Estimated Tax by Individuals,

N-210

2014

Estates, and Trusts

(REV. 2014)

See Separate Instructions

Attach to Form N-11, N-13, N-15, or N-40

(NOTE: References to “married”, “unmarried”, and “spouse” also means “in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

Name(s) as shown on tax return

Social Security Number or FEIN

Part I

Reasons For Filing —

If a, b, or c below applies to you, you may be able to lower or eliminate your penalty. But you

MUST check the boxes that apply and file Form N-210 with your tax return. If d below applies to you, check that box and

file Form N-210 with your tax return.

Check whichever boxes apply:

a

You request a waiver. In certain circumstances, the Department of Taxation will waive all or part of the penalty. See the Instructions for

Waiver of Penalty.

b

You use the annualized income installment method. If your income varied during the year, this method may reduce the amount of one or

more required installments. See the Instructions for Schedule A.

c

You had Hawaii income tax withheld from wages and you treat it as paid for estimated tax purposes when it was actually withheld instead

of in equal amounts on the payment due dates. See the Instructions for line 10.

d

One or more of your required installments (line 9) are based upon your 2013 tax and you filed or are filing a joint return for either 2013 or

2014 but not for both years.

Part II

All Filers Must Complete This Part

1 2014 tax liability. (See Instructions) ...............................................................................................................................

1

2 Total credits. (See Instructions) .....................................................................................................................................

2

3 Balance. Line 1 minus line 2. .........................................................................................................................................

3

4 Hawaii income taxes withheld. (See Instructions) .........................................................................................................

4

5 Balance. Line 3 minus line 4. If this amount is less than $500, stop here; do not complete or file this form.

You do not owe the penalty. ...........................................................................................................................................

5

6 Multiply the amount on line 3 by 60% (.60). ...................................................................................................................

6

7

7 Enter the tax amount from your 2013 income tax return. (Caution: See Instructions) .................................................

8 Enter the smaller of line 6 or line 7. (See Instructions) .................................................................................................

8

Part III

Figure Your Underpayment

PAYMENT DUE DATES

(a) 4/20/2014

(b) 6/20/2014

(c) 9/20/2014

(d) 1/20/2015

9 Required installments. If you are using the Annualized Income

Installment Method, enter the amounts from Schedule A,

line 24. Farmers and fishermen, enter the amount from line 8 in

column (d). All others, enter ¼ of line 8 in each column. .....

9

10 Estimated and other tax payments made. (See Instructions)

For column (a) only, enter the amount from line 10 on line

14 also. If line 10 is equal to or more than line 9 for all

payment periods, stop here; you do not owe the penalty. .....

10

Complete lines 11 through 17 of one column

before going to the next column.

11 Enter amount, if any, from line 17 of previous column. .........

11

12 Add lines 10 and 11. .............................................................

12

13 Add amounts on lines 15 and 16 of the previous column. ....

13

14 Line 12 minus line 13. If zero or less, enter -0-. For column

(a) only, enter the amount from line 10. ................................

14

15 If the amount on line 14 is zero, line 13 minus line 12.

Otherwise, enter -0-. .............................................................

15

16 Underpayment. If line 9 is equal to or more than line 14, line 9 minus

line 14, then go to line 11 of next column. Otherwise go to line 17. ........

16

17 Overpayment. If line 14 is more than line 9, line 14 minus

line 9, then go to line 11 of next column. ..............................

17

Complete Part IV on page 2 to figure the penalty. If there are no entries on line 16, no penalty is owed.

Form N-210

1

1 2

2