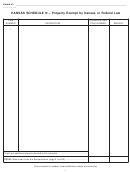

Form K-706 - Kansas Estate Tax Return For Deaths Occurring In 2007, 2008 And 2009 Page 8

ADVERTISEMENT

Estate of:

______________________________________________________________________________________

K-706 (Rev. 1/07)

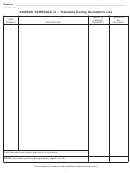

KANSAS SCHEDULE E – Jointly Owned Property

SECTION I – Qualified Joint Interests (Interests Held by the Decedent and His or Her Spouse as the Only Joint Tenants)

VALUE OF

VALUE OF

ITEM

KANSAS

ALL

DESCRIPTION

NUMBER

PROPERTY

PROPERTY

1

Total from additional sheets attached to this schedule ..................................................

1a Total Property Held by the Decedent and Spouse as the Only Joint Tenants ..........

1b One-half (1/2) to be Included in Gross Estate (enter 1/2 of line 1a) .........................

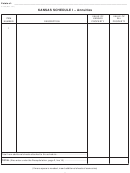

SECTION II – All Other Joint Interests

2a Name and address of each surviving co-tenant. If more than six surviving co-tenants, list the additional co-tenants on

an attached sheet.

A.

D.

B.

E.

C.

F.

VALUE OF

VALUE OF

ITEM

ENTER LETTER

KANSAS

ALL

NUMBER

FOR CO-TENANT

DESCRIPTION

PROPERTY

PROPERTY

1

Total from additional sheets attached to this schedule ...................................................

2b Total Property Held in Joint Tenancy by Decedent and Another ...............................

Total Includible Joint Interest (Add lines 1b and 2b. Also enter on the

Recapitulation, page 2, line 14) .....................................................................................

(If more space is needed, insert additional sheets of same size)

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19