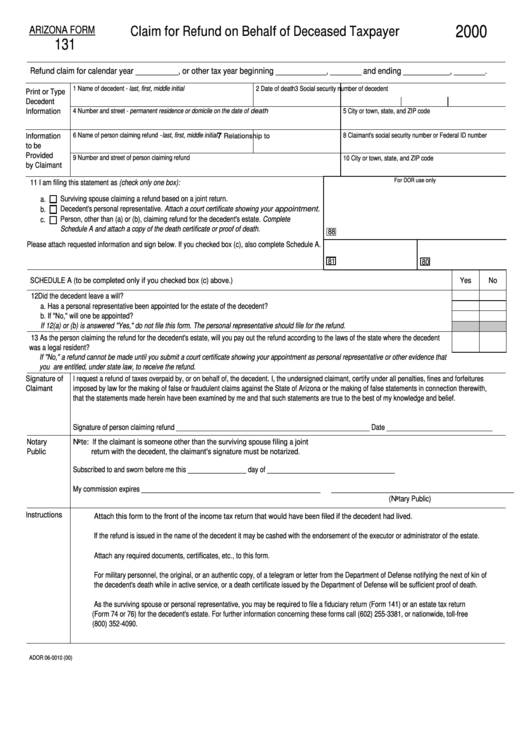

Arizona Form 131 - Claim For Refund On Behalf Of Deceased Taxpayer 2000

ADVERTISEMENT

2000

Claim for Refund on Behalf of Deceased Taxpayer

ARIZONA FORM

131

Refund claim for calendar year ___________, or other tax year beginning _____________, ________ and ending ____________, ________.

1 Name of decedent - last, first, middle initial

2 Date of death

3 Social security number of decedent

Print or Type

Decedent

Information

4 Number and street - permanent residence or domicile on the date of death

5 City or town, state, and ZIP code

6 Name of person claiming refund - last, first, middle initial

8 Claimant's social security number or Federal ID number

Information

7

Relationship to

to be

Provided

9 Number and street of person claiming refund

10 City or town, state, and ZIP code

by Claimant

For DOR use only

11 I am filing this statement as (check only one box):

Surviving spouse claiming a refund based on a joint return.

a.

Decedent's personal representative. Attach a court certificate showing your appointment.

b.

Person, other than (a) or (b), claiming refund for the decedent's estate. Complete

c.

Schedule A and attach a copy of the death certificate or proof of death.

88

Please attach requested information and sign below. If you checked box (c), also complete Schedule A.

81

80

SCHEDULE A (to be completed only if you checked box (c) above.)

Yes

No

12 Did the decedent leave a will? .....................................................................................................................................................................................

a. Has a personal representative been appointed for the estate of the decedent? .....................................................................................................

b. If "No," will one be appointed? ................................................................................................................................................................................

If 12(a) or (b) is answered "Yes," do not file this form. The personal representative should file for the refund.

13 As the person claiming the refund for the decedent's estate, will you pay out the refund according to the laws of the state where the decedent

was a legal resident? ........................................................................................................................................................................................................

If "No," a refund cannot be made until you submit a court certificate showing your appointment as personal representative or other evidence that

you are entitled, under state law, to receive the refund.

I request a refund of taxes overpaid by, or on behalf of, the decedent. I, the undersigned claimant, certify under all penalties, fines and forfeitures

Signature of

imposed by law for the making of false or fraudulent claims against the State of Arizona or the making of false statements in connection therewith,

Claimant

that the statements made herein have been examined by me and that such statements are true to the best of my knowledge and belief.

Signature of person claiming refund _____________________________________________________ Date _____________________________

Notary

Note: If the claimant is someone other than the surviving spouse filing a joint

Public

return with the decedent, the claimant's signature must be notarized.

Subscribed to and sworn before me this ________________ day of ___________________________________

My commission expires _________________________________________________

__________________________________________________

(Notary Public)

Instructions

Attach this form to the front of the income tax return that would have been filed if the decedent had lived.

If the refund is issued in the name of the decedent it may be cashed with the endorsement of the executor or administrator of the estate.

Attach any required documents, certificates, etc., to this form.

For military personnel, the original, or an authentic copy, of a telegram or letter from the Department of Defense notifying the next of kin of

the decedent's death while in active service, or a death certificate issued by the Department of Defense will be sufficient proof of death.

As the surviving spouse or personal representative, you may be required to file a fiduciary return (Form 141) or an estate tax return

(Form 74 or 76) for the decedent's estate. For further information concerning these forms call (602) 255-3381, or nationwide, toll-free

(800) 352-4090.

ADOR 06-0010 (00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1