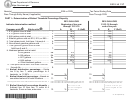

2015 IA 133 New Jobs Tax Credit Instructions

A New Jobs Tax Credit can be claimed by a

employees for a new product line transfers an

taxpayer who has entered into an Iowa Industrial

in-state employee to be foreman of the new

New Jobs Training (260E) agreement with a

product line and fills the transferred employee’s

community college and who has increased

position with a new employee. The new

employment over the base employment level by

foreman’s position would be considered a job

at least 10.0%. The tax credit can be claimed in

directly related to new jobs because it directly

any tax year that either begins or ends during the

supports the new jobs and the transferred

term of the 260E agreement. However, the tax

employee’s old position was filled by a new

credit may not be taken until the base

employee.

employment level has been exceeded by at least

Any credit in excess of the tax liability for the tax

10.0%. In the case of a taxpayer without a base

year may be credited to the tax liability for the

employment level, the tax credit can be claimed

following 10 tax years or until depleted,

for all eligible new jobs for the tax year selected

whichever is earlier. Complete the IA 133 even if

by the taxpayer. The tax credit can only be

you are only claiming a New Jobs Tax Credit

claimed once for each new job.

carryforward from a prior tax year.

Base employment level means the number of

A separate IA 133 must be completed for each

full-time jobs a business employs at the location

different 260E agreement under which a New

covered by the 260E agreement on the date of

Jobs Tax Credit, new or carryforward, is claimed.

the agreement. A full-time job includes any

Apportionment of T a x Credit

position with an average work week of 35 or

If the business is a partnership, LLC, S

more hours or a salaried position. Part-time jobs

corporation, estate, or trust, the tax credit must

must be aggregated to equal a full-time job. A

be apportioned to the members. The pass-

job with average weekly hours below 15 counts

through entity must file the IA 133 with its return.

as 0.25; a job with hours greater than or equal to

On Schedule K-1 or on an attachment to

15 but less than 25 counts as 0.5; and a job with

Schedule K-1, report the tax credit for each

hours greater than or equal to 25 but less than

member, including the tax credit certificate

35 counts as 0.75.

number for the 260E agreement, and instruct the

In determining if the taxpayer has increased

members to report the apportioned tax credit on

employment over the base employment level by

line 10 of form IA 133 and include it with their tax

at least 10.0%, only those new jobs directly

returns. Also direct members to report their

resulting from the project covered by the

share of the New Jobs Tax Credit on Part I of the

agreement and those directly related to those

IA 148 Tax Credits Schedule with the tax credit

new jobs are eligible. New jobs directly resulting

certificate

number

assigned

to

the

260E

from a project do not include jobs of recalled

agreement.

workers or replacement jobs or other jobs that

Schedules A and B New Jobs Details

formerly existed at the location. New jobs directly

Schedules A and B must be completed to

related to the new jobs resulting from the project

demonstrate eligibility for the New Jobs Tax

means those jobs which directly support the new

Credit. In Schedule A, provide the name, SSN,

jobs. However, those new jobs do not include an

and job title for employees in the

new jobs

in-state employee transferred to a position which

directly resulting from the project covered by the

would be considered a new job directly related to

agreement. In Schedule B, provide the name,

the new jobs resulting from the project unless the

SSN, and job title for employees in the new jobs

transferred employee’s vacant position is filled

directly related to the new jobs reported in

by a new employee. The burden of proof that a

Schedule A. Complete multiple schedules if

new job is directly related to the new jobs

more lines are needed. Also report total wages

resulting from the project is on the taxpayer.

paid to each employee during calendar year

Example: A taxpayer who has entered into a

2015 in column D. If any of the listed employees

chapter

260E

agreement

to

train

new

worked less than 35 hours per week, indicate the

41-133c (09/17/15)

1

1 2

2 3

3 4

4