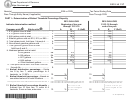

applicable share of hours in column E; enter 0.75

qualifying taxable wages are the first $27,300

if hours are greater than or equal to 25 but less

wages paid to employees in new jobs or in jobs

than 35; enter 0.5 if hours are greater than or

directly related to those new jobs. This is the

equal to 15 but less than 25; enter 0.25 if hours

amount of taxable wages on which an employer

are below 15; enter 1 if a full-time job.

is required to pay unemployment taxes. Add the

totals from Schedule A and Schedule B in

Column F equals qualifying taxable wages for

column F.

the employees in jobs for which the taxpayer is

claiming the New Jobs Tax Credit this tax year.

If the taxpayer is a C corporation, the amount in

Multiply the lesser of column D or $27,300 by the

line 9 of this form must be placed in column D of

hours share in column E to calculate qualifying

Part I on the IA 148 Tax Credits Schedule; use

taxable wages in column F. If the taxpayer

tax credit code 08 in column A. Enter the tax

claimed a tax credit for the listed employee in a

credit certificate number awarded with the 260E

prior tax year, leave column F blank. If the

agreement in column B. Use the IA 148 Tax

taxpayer chooses to not claim a tax credit this

Credits Schedule to determine the allowable

tax year for a listed employee, leave column F

credit that can be claimed in the current tax year

blank.

and any carryforward. Any carryforward from

prior year(s) claimed under the same 260E

In the final rows of each schedule, total columns

contract must be reported in line 11 of this form

E and F. Enter the Schedule A, column E sum in

and placed in column C of the same line on the

line 3 of the IA 133. Enter the Schedule B,

IA 148. If the taxpayer is only reporting a

column E sum in line 4 of the IA 133. Add the

carryforward claim, complete line 11 of this form

Schedules A and B, column F totals and enter

as well as all the fields at the top.

that sum in line 7 of the IA 133.

If the taxpayer has received any new pass-

2015 IA 133 Instructions

through New Jobs Tax Credit from a partnership,

LLC, S corporation, estate, or trust, indicate that

Provide your name, SSN or FEIN, and tax period

amount on line 10 of this form. Also enter the

ending date. Also report

the tax credit certificate

amount in column D of Part I on the IA 148 Tax

issued with the 260E agreement.

Credits Schedule. If you have a carryforward tax

Line 2: Number of new jobs covered in the

credit received from a pass-through in a prior tax

agreement - Report the number of new jobs

year, indicate that amount on line 11 of this form.

pledged in the 260E agreement with the

Also enter the amount in column C of Part I on

community college.

the IA 148 Tax Credits Schedule. For either a

Line 3: Number of new jobs claimed - Report

new claim or carryforward claim, use tax credit

the number of new jobs which equals the sum of

code 08 in column A and report the 260E

column E in Schedule A on the IA 133; add

certificate number in column B. Provide the

additional

schedules

if

more

than

fifteen

pass-through name in column M and FEIN in

employees.

column N of Part IV on the IA 148 Tax Credits

Schedule as well as on the top of this form.

Line 4: Number of jobs directly related to the

new jobs claimed - Report the number of jobs

File a separate IA 133 for each pass-through

directly related to the new jobs which equals the

New Jobs Tax Credit

received. Also list the

sum of column E in Schedule B on the IA 133;

claims separately on Part I of the IA 148 Tax

add additional schedules if more than six

Credits Schedule with each tax credit certificate

employees.

number and provide each pass-through name

and FEIN in Part

IV.

Line 7: Qualifying taxable wages - For 2015,

41-133d (07/30/15)

1

1 2

2 3

3 4

4