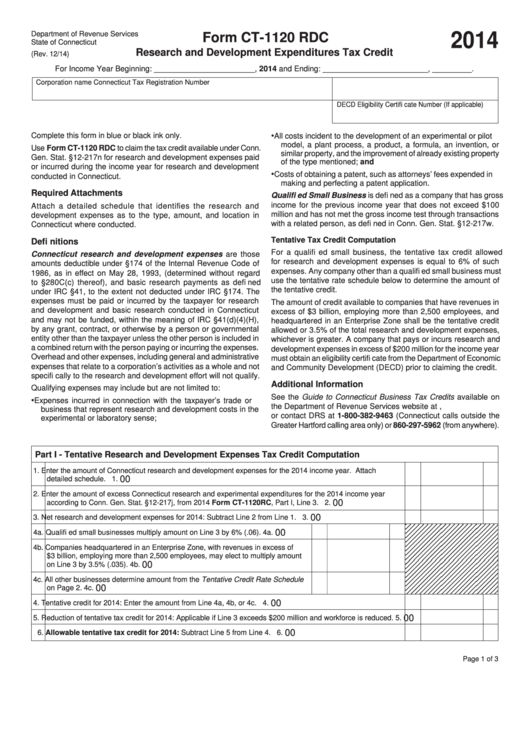

Form Ct-1120 Rdc - Connecticut Research And Development Expenditures Tax Credit - 2014

ADVERTISEMENT

Department of Revenue Services

2014

Form CT-1120 RDC

State of Connecticut

Research and Development Expenditures Tax Credit

(Rev. 12/14)

For Income Year Beginning: _______________________ , 2014 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

DECD Eligibility Certifi cate Number (If applicable)

Complete this form in blue or black ink only.

•

All costs incident to the development of an experimental or pilot

model, a plant process, a product, a formula, an invention, or

Use Form CT-1120 RDC to claim the tax credit available under Conn.

similar property, and the improvement of already existing property

Gen. Stat. §12-217n for research and development expenses paid

of the type mentioned; and

or incurred during the income year for research and development

•

Costs of obtaining a patent, such as attorneys’ fees expended in

conducted in Connecticut.

making and perfecting a patent application.

Required Attachments

Qualifi ed Small Business is defi ned as a company that has gross

income for the previous income year that does not exceed $100

Attach a detailed schedule that identifies the research and

million and has not met the gross income test through transactions

development expenses as to the type, amount, and location in

with a related person, as defi ned in Conn. Gen. Stat. §12-217w.

Connecticut where conducted.

Tentative Tax Credit Computation

Defi nitions

For a qualifi ed small business, the tentative tax credit allowed

Connecticut research and development expenses are those

for research and development expenses is equal to 6% of such

amounts deductible under §174 of the Internal Revenue Code of

expenses. Any company other than a qualifi ed small business must

1986, as in effect on May 28, 1993, (determined without regard

use the tentative rate schedule below to determine the amount of

to §280C(c) thereof), and basic research payments as defi ned

the tentative credit.

under IRC §41, to the extent not deducted under IRC §174. The

expenses must be paid or incurred by the taxpayer for research

The amount of credit available to companies that have revenues in

and development and basic research conducted in Connecticut

excess of $3 billion, employing more than 2,500 employees, and

and may not be funded, within the meaning of IRC §41(d)(4)(H),

headquartered in an Enterprise Zone shall be the tentative credit

by any grant, contract, or otherwise by a person or governmental

allowed or 3.5% of the total research and development expenses,

entity other than the taxpayer unless the other person is included in

whichever is greater. A company that pays or incurs research and

a combined return with the person paying or incurring the expenses.

development expenses in excess of $200 million for the income year

Overhead and other expenses, including general and administrative

must obtain an eligibility certifi cate from the Department of Economic

expenses that relate to a corporation’s activities as a whole and not

and Community Development (DECD) prior to claiming the credit.

specifi cally to the research and development effort will not qualify.

Additional Information

Qualifying expenses may include but are not limited to:

See the Guide to Connecticut Business Tax Credits available on

•

Expenses incurred in connection with the taxpayer’s trade or

the Department of Revenue Services website at ,

business that represent research and development costs in the

or contact DRS at 1-800-382-9463 (Connecticut calls outside the

experimental or laboratory sense;

Greater Hartford calling area only) or 860-297-5962 (from anywhere).

Part I - Tentative Research and Development Expenses Tax Credit Computation

1. Enter the amount of Connecticut research and development expenses for the 2014 income year. Attach

00

detailed schedule.

1.

2. Enter the amount of excess Connecticut research and experimental expenditures for the 2014 income year

00

according to Conn. Gen. Stat. §12-217j, from 2014 Form CT-1120RC, Part I, Line 3.

2.

00

3. Net research and development expenses for 2014: Subtract Line 2 from Line 1.

3.

00

4a. Qualifi ed small businesses multiply amount on Line 3 by 6% (.06).

4a.

4b. Companies headquartered in an Enterprise Zone, with revenues in excess of

$3 billion, employing more than 2,500 employees, may elect to multiply amount

00

on Line 3 by 3.5% (.035).

4b.

4c. All other businesses determine amount from the Tentative Credit Rate Schedule

00

on Page 2.

4c.

00

4. Tentative credit for 2014: Enter the amount from Line 4a, 4b, or 4c.

4.

00

5. Reduction of tentative tax credit for 2014: Applicable if Line 3 exceeds $200 million and workforce is reduced.

5.

00

6. Allowable tentative tax credit for 2014: Subtract Line 5 from Line 4.

6.

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3