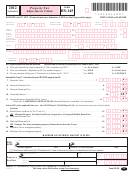

Claimant’s Last Name

Social Security Number

*161221200*

* 1 6 1 2 2 1 2 0 0 *

DUE DATE: April 18, 2016. Claims accepted up to Oct. 17, 2016.

PROPERTY TAX ADJUSTMENT CLAIM

SECTION B.

For Household Income up to $137,500. Attach Schedule HI-144

To qualify, you must meet the requirements for filing a homestead declaration in addition to the following requirements.

ALL eligibility questions must be answered.

B1. Were you domiciled in Vermont all of calendar year 2015? . . . . . . . . . . . . . . .

Yes, Go to Line B2.

No, STOP

c

c

B2. Were you claimed as a dependent in 2015 by another taxpayer? . . . . . . . . . . . .

Yes, STOP

No, Go to Line B3.

c

c

B3. Do you anticipate selling your Vermont housesite on or before April 1, 2016? .

Yes, STOP

No, CONTINUE

c

c

Amounts for Lines B4 - B6 are found on the 2015/2016 property tax bill. Round amounts to the nearest dollar.

.0 0

B4. Housesite Value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B4.____________________

.0 0

B5. Housesite Education Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B5.____________________

.0 0

B6. Housesite Municipal Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B6.____________________

.0 0 %

B7. Ownership Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B7.____________________

.0 0

B8. Household Income (Schedule HI-144, Line y) . Schedule HI-144 MUST be attached. . . . . . . . . . . B8.____________________

B8a. If Amended Schedule HI-144, Household Income, is attached, check here .

c

Complete the following ONLY if applicable. See instructions for details .

Lot Rent

.0 0

B9. Mobile Home Lot Rent (Form LC-142, Line 16 - attach Form to this claim) . . . . . . . . . . . . . . . . . . . B9.____________________

OR Allocated Property Tax from Land Trust, Cooperative, or Nonprofit Mobile Home Park

.0 0

B10. Allocated Education Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B10.____________________

.0 0

B11. Allocated Municipal Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B11.____________________

OR Property Tax from contiguous property if housesite has less than 2 acres (see instructions) .

.0 0

B12. Contiguous property Education Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B12.____________________

.0 0

B13. Contiguous property Municipal Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B13.____________________

MAXIMUM ADJUSTMENT AMOUNT IS $8,000.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct and complete . Preparers cannot use return information for purposes other than preparing returns .

Signature

Date

Telephone Number

Signature. If a joint return, BOTH must sign.

Date

Check here if authorizing the Vermont Department of Taxes to discuss this return and attachments with your preparer.

Preparer’s signature

Date

Preparer’s

SSN or

Preparer’s

PTIN

Use Only

Firm’s name (or yours if self-employed) and address

EIN

Preparer’s Telephone Number

5454

Mail to: Vermont Department of Taxes

PO Box 1881

Montpelier, VT 05601-1881

Form HS-122, page 2 of 2

Save and go to

Clear ALL fields

Save and Print

Important Printing Instructions

1

1 2

2 3

3 4

4