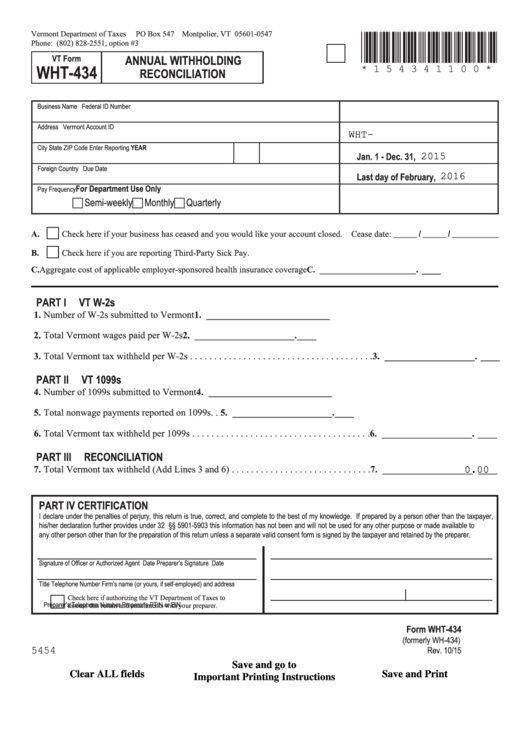

Vermont Department of Taxes

PO Box 547 Montpelier, VT 05601-0547

*154341100*

Phone: (802) 828-2551, option #3

ANNUAL WITHHOLDING

VT Form

WHT-434

* 1 5 4 3 4 1 1 0 0 *

RECONCILIATION

Business Name

Federal ID Number

Address

Vermont Account ID

WHT-

Enter Reporting YEAR

City

State

ZIP Code

2015

Jan. 1 - Dec. 31,

Foreign Country

Due Date

2016

Last day of February,

For Department Use Only

Pay Frequency

c Semi-weekly

c Monthly

c Quarterly

c

Check here if your business has ceased and you would like your account closed . Cease date: ______ / ______ / ____________

A.

c

B.

Check here if you are reporting Third-Party Sick Pay .

. ____

C. Aggregate cost of applicable employer-sponsored health insurance coverage . . . . . . . . . . . . C. ______________________

PART I

VT W-2s

1. Number of W-2s submitted to Vermont . . . . . . 1. __________________________

2. Total Vermont wages paid per W-2s . . . . . . . . . 2. _____________________ . ____

3. Total Vermont tax withheld per W-2s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. ___________________ . ____

PART II

VT 1099s

4. Number of 1099s submitted to Vermont . . . . . 4. __________________________

5. Total nonwage payments reported on 1099s . . 5. _____________________ . ____

6. Total Vermont tax withheld per 1099s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6. ___________________ . ____

PART III

RECONCILIATION

7. Total Vermont tax withheld (Add Lines 3 and 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7. ___________________ . ____

0.00

PART IV CERTIFICATION

I declare under the penalties of perjury, this return is true, correct, and complete to the best of my knowledge. If prepared by a person other than the taxpayer,

his/her declaration further provides under 32 V.S.A. §§ 5901-5903 this information has not been and will not be used for any other purpose or made available to

any other person other than for the preparation of this return unless a separate valid consent form is signed by the taxpayer and retained by the preparer.

Signature of Officer or Authorized Agent

Date

Preparer’s Signature

Date

Title

Telephone Number

Firm’s name (or yours, if self-employed) and address

Check here if authorizing the VT Department of Taxes to

Preparer’s Telephone Number

Preparer’s PTIN or EIN

discuss this return and attachments with your preparer .

Form WHT-434

(formerly WH-434)

5454

Rev. 10/15

Save and go to

Clear ALL fields

Save and Print

Important Printing Instructions

1

1