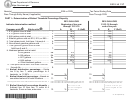

PART II – Determination of Credit

For Site-by-site method, provide name and address of Iowa Retail Motor Fuel Site

Name

Address

City and ZIP

Credit calculation for both Company-

2014 Gallons

2015 Gallons

Beginning of tax year through 12-31-14

01-01-15 through end of tax year

wide and Site-by-site methods

A

B

1.

Total pure ethanol sold. Enter line

5 of Part I, Column C/F ..................

1.

1.

2.

Eligible tax credit rate per gallon....

2.

2.

If column A, line 12 of Part I=0.00%, enter

If column D, line 12 of Part I=0.00%, enter

$0.08 (eight cents)

$0.08 (eight cents)

If column A, line 12 of Part I=0.01 to 2.00%,

If column D, line 12 of Part I=0.01 to 2.00%,

enter $0.06 (six cents)

enter $0.06 (six cents)

If column A, line 12 of Part I=2.01 to 4.00%,

If column D, line 12 of Part I=2.01 to 4.00%,

enter $0.04 (four cents)

enter $0.04 (four cents)

3.

Credit for ethanol sold. Multiply

line 1 by line 2 ...............................

3.

3.

4.

Add lines 3A and 3B ......................

4.

PART III – Final Credit Calculation (complete only once for Site-by-site method)

1.

Ethanol Promotion Tax Credit:

Company-wide method - Line 4 of Part II

Site-by-site method - Add all line 4’s from all Part II’s ......................................

1.

2.

Pass-through Ethanol Promotion Tax Credit from partnership, LLC, S

corporation, estate, or trust.

Enter on Part II of the IA 148 Tax Credits Schedule and provide pass-through

information on Part IV ...............................................................................................

2.

IA 148 Tax Credits Schedule must be completed.

41-151b (07/05/14)

*1441151029999*

1

1 2

2 3

3 4

4 5

5