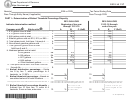

Part II – Determination of Credit

Part III - Final Credit Calculation

Site-by-site:

Site-by-site:

Complete Part III of the IA 137 only once. Add the credit

Provide the name and address of the retail motor fuel site

calculated for all retail motor fuel sites on line 4 of all Part II’s

including street, city, and Zip Code.

and place on Part III line 1 of the IA 137. Individuals and C

The Ethanol Promotion Tax Credit for each retail motor fuel site

corporations, enter in Part II of the IA 148 Tax Credits Schedule

is calculated by multiplying the retail dealer’s total ethanol sold at

using tax credit code 64.

that site by the tax credit rate, which is dependent upon the retail

Company-wide:

site’s biofuel threshold percentage disparity calculated under

Part I. On line 1, report ethanol sales for the retail motor fuel site

Place the credit calculated on line 4 of Part II on Part III line 1 of

calculated on line 5, column D/F of Part I. For fiscal year filers,

the IA 137. Individuals and C corporations, enter in Part II of the

split sales between calendar years.

IA 148 Tax Credits Schedule using tax credit code 64.

Enter the applicable credit rate for the retail site in line 2 as

Pass-through credits:

noted under line 2.

If the taxpayer has received any pass-through Ethanol

Promotion Tax Credit from a partnership, LLC, S corporation,

Compute the credit for the retail motor fuel site on line 3 by

estate, or trust, indicate that amount on one Part III line 2 of the

multiplying the tax credit rate entered on line 2 by total ethanol

IA 137. Also enter the amount on Part II of the IA 148 Tax

sold in line 1 for each calendar year in which ethanol sales are

Credits Schedule, using tax credit code 64, and provide the

reported.

pass-through name and FEIN in Part IV of the IA 148 Tax

Company-wide:

Credits Schedule. File a separate IA 137 for each pass-through

The credit is calculated by multiplying the taxpayer’s total ethanol

Ethanol Promotion Tax Credit received. List the claims

sold by the tax credit rate, which is dependent upon the

separately on Part II of the IA 148 Tax Credits Schedule,

taxpayer’s biofuel threshold percentage disparity calculated

providing each pass-through name and FEIN in Part IV.

under Part I on a Company-wide basis. On line 1 report ethanol

The Ethanol Promotion Tax Credit can be claimed even if the

sales for the company calculated on line 5, column D/F of Part I.

taxpayer also claims the E85 Gasoline Promotion Tax Credit or

For fiscal year filers, split sales between calendar years.

the E15 Plus Gasoline Promotion Tax Credit for the same

Enter the applicable credit rate on line 2, as noted under line 2.

ethanol gallons sold.

Compute the credit for the company on line 3 by multiplying the

Any credit in excess of tax liability can be refunded or credited to

tax credit rate entered on line 2 by total ethanol sold in line 1 for

tax liability for the following year.

each calendar year in which ethanol sales are reported.

41-151e (07/21/14)

1

1 2

2 3

3 4

4 5

5