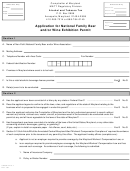

6. Is the building complete and ready for use?

Yes

No

Please provide expected date of completion.

7. Will there be a manager to oversee the day-to-day operations of the liquor license?

Yes

Please send a management agreement.

No

Section 5. Additional Application Materials

•

Proof of possessory interest in the premises to be licensed such as a lease, purchase agreement or tax bill;

•

Floor plan for premises, using approximate dimensional measurements, including external dimensions and

general layout – on an 8-1/2” x 11” sheet of paper. Note: On the floor plan you will need to clearly mark the areas

where alcohol will be served, sold and stored. The floor plan must contain outside dimensions, the name of the

establishment, physical address and date;

•

Bank Signature Card for the owning entity;

•

Federal Employer Identification Number (FEIN) as filed with the Internal Revenue Service (IRS). You can apply for

an FEIN on the IRS website at by clicking on the link under Online Services;

•

Management Agreement for any individual who manages the day-to-day business of the liquor operation;

•

Personal History Statement and two fingerprint cards for each officer, director and/or manager;

•

Articles of Incorporation issued by the Secretary of State’s office;

•

Copy of your tax exempt certificate issued by the Internal Revenue Service;

•

Verification of the federal tax code section under which your operation received its federal tax exemption;

•

Liquor Division Authorization to Disclose Tax Information (Form LIQ-AUTH).

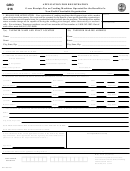

Section 6. Declaration and Affidavit

This application needs to be signed by two persons:

1. Presiding officer of the board of directors and the president; or

2. Presiding officer of the board or the president, and one vice president, secretary, treasurer, or executive director.

I/We declare under penalty of false swearing that the information provided on this application, including required and

applicable documents, is true, correct, and complete.

_______________________

_____________

___________________ ____________________

Signature

Date

Printed Name

Title

_______________________

_____________

___________________ ____________________

Signature

Date

Printed Name

Title

_______________________

_____________

___________________ ____________________

Signature

Date

Printed Name

Title

Mail completed application and all required and applicable documents to:

Montana Department of Revenue

Liquor Control Division

PO Box 1712

Helena, MT 59624-1712

Questions? Call us toll free at 1-866-859-2254 (in Helena, 444-6900), or fax 406-444-0722.

Non-Profit Arts Organization Beer and Table Wine Application

Page 3

1

1 2

2 3

3