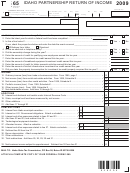

Form Id K-1 - Partner'S, Shareholder'S, Or Beneficiary'S Share Of Idaho Adjustments, Credits, Etc. - 2015 Page 4

ADVERTISEMENT

EFO00201p4

Form ID K-1 - Page 2

07-14-15

breakdown of this income and related expenses on page 2,

The entity must either complete Sections A through E for an

electing owner or include a schedule that identifies how the tax

Part E.

for the owner was computed, including any credits that are used

A nonresident will need to remove allocated income from federal

to offset tax.

Schedule K-1 amounts before applying the apportionment factor

listed on line 1 to determine the amount of business income

Line f Withholding Paid on Behalf of Owner

A pass-through entity transacting business in Idaho, including

apportioned to Idaho. Income allocated to Idaho (line 10)

a trust or estate with income taxable in Idaho, must withhold

will then be added to the apportioned income to compute the

income tax from a nonresident individual owner who isn't

amounts of Idaho source income to report on Form 43 or 66.

included in a composite return. Enter the amount of Idaho

income tax withheld.

Line 8 Allocated Income

Enter the owner’s distributive share of the amount reported on

PART A ALLOCATION AND APPORTIONMENT

Form 41S, line 29 or Form 65, line 27. Include a schedule or use

If the entity is a trust or estate, skip Part A.

Part E to identify the income.

Line 1 Total Income

Line 9 Nonbusiness Expense Offset

Enter the owner’s distributive share of total income reported on

Enter the owner’s distributive share of the amount reported on

federal Form 1120S, line 6, or federal Form 1065, line 8.

Form 41S, line 30 or Form 65, line 28.

This amount doesn't go on the owner's Idaho return. It's used

Line 10 Income and Expenses Allocated to Idaho

Enter the owner’s distributive share of nonbusiness income

to calculate the interest expense offset related to tax-exempt

allocated to Idaho. This amount is net of the nonbusiness expense

interest. If the owner isn't reporting a deduction for tax-exempt

interest, the owner won't use this information in preparing the

offset and reported on Form 41S, line 39 or Form 65, line 37. Include

Idaho return.

a schedule or use Part E to identify the income and expenses.

PART B IDAHO ADJUSTMENTS

Line 2 Idaho Apportionment Factor

Enter 100% on this line if the entity is transacting all of its

Report all amounts at the owner's distributive share before

business within Idaho; if not, enter the Idaho apportionment

applying the Idaho apportionment factor.

factor from Form 42, Part I, line 21.

Line 1 State, Municipal, and Local Taxes Measured by Net

This information is used by a part-year resident or nonresident

Income

individual, trust, or estate to determine the amount of the entity's

Enter the owner’s distributive share of the amount reported on

business income that must be reported as Idaho source income

Form 41S, line 21, Form 65, line 18, or Form 66, Schedule B,

while a nonresident of Idaho. The apportionment factor doesn't

line 3. Include a schedule or use Part E to identify the amount

and the governmental entity.

apply to allocated income (lines 8 through 10).

If the entity is filing an Idaho Form 66, the entity may be eligible

Lines 3 Through 7

Lines 3 through 7 should be completed only by an entity that is

to claim a credit for taxes paid on Form 66, Schedule C, line 2.

a partnership or is taxed as a partnership. All other entities skip

lines 3 through 7 and go to line 8. If the partner is an individual,

Line 2 Bonus Depreciation Addition

For assets acquired before 2008 or after 2009 for which you

trust, or estate, the partnership can skip lines 3 through 7.

claimed bonus depreciation, enter the owner's distributive share

Enter the owner’s share of the partnership’s total everywhere

of the differences between the federal and Idaho depreciation

and Idaho property, payroll, and sales, net of intercompany

and gains and losses reported on Form 41S, line 17, Form 65,

eliminations, in the spaces provided. These amounts can be

line 19, or Form 66, Schedule B, line 5.

found on the partnership's Idaho Form 42. The capitalized

rent expense on line 5 is the amount of rent expense net of

Line 3 Interest and Dividends Not Taxable Under the IRC

intercompany rent expense after being capitalized by eight.

Enter the owner’s distributive share of the amount reported on

Form 41S, line 20, Form 65, line 17, or Form 66, Schedule B,

The owner's share of the partnership’s total everywhere and

line 2. Except for amortization, don’t include expenses

Idaho property, payroll, and sales is determined by attributing

associated with the securities on this line. Report the expenses

the partnership’s property, payroll, and sales to the owner in the

on line 7a.

same proportion as the owner’s distributive share of partnership

income if reporting net income for the tax year or in the same

Line 4 Other Idaho Additions

proportion as the owner’s distributive share of partnership losses

Enter the owner’s distributive share of any other Idaho additions

not included on lines 1 through 3 above. Include a schedule or

if reporting a net loss for the tax year.

use Part E to identify the additions.

These amounts are used if the owner is a corporation or

partnership to compute its Idaho apportionment factor. The

Line 5 Interest from Idaho Municipal Securities

amounts will be added to the entity's property, payroll, and sales

Enter the owner’s distributive share of the amount reported on

amounts in computing its Idaho factors if the income from the

Form 41S, line 24, Form 65, line 22, or Form 66, Schedule B,

entity is business income to the entity.

line 8. Except for amortization, don’t include expenses

associated with the securities on this line. Report the expenses

on line 7b.

Lines 8 Through 10

Lines 8 through 10 are used by all owners except residents.

Nonresident individuals, trusts, and estates will need to know

Line 6 Interest on U.S. Government Obligations

Enter the owner’s distributive share of the amount reported on

what income is allocated income since this income is not

apportioned to determine Idaho source income. Instead,

Form 41S, line 25, Form 65, line 23, or included in the amount on

allocated income (and the related nonbusiness expense offset

Form 66, page 1, line 5. Except for amortization, don’t include

amount on line 9) is specifically sourced to a state. Income

expenses associated with the securities on this line. Report the

allocated to Idaho is listed on line 10. Provide a detailed

expenses on line 7c.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5