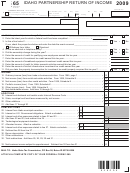

Form Id K-1 - Partner'S, Shareholder'S, Or Beneficiary'S Share Of Idaho Adjustments, Credits, Etc. - 2015 Page 5

ADVERTISEMENT

Form ID K-1 - Page 3

EFO00201p5

07-14-15

Line 7 Interest and Other Expenses Related to Lines 3, 5,

Line 2 Contributions to Idaho Youth and Rehabilitation

Facilities

and 6

On lines 7a through 7c, enter the owner’s distributive share of

Enter the owner’s distributive share of the total amount of

qualifying contributions to Idaho youth and rehabilitation facilities.

interest and other expenses related to the income reported on

lines 3, 5, and 6.

PART D IDAHO CREDITS AND CREDIT RECAPTURE

For lines 1 through 17, enter the owner’s distributive share of

Line 8 Bonus Depreciation Deduction

For assets acquired before 2008 or after 2009 for which you

Idaho credits and Idaho credit recapture.

claimed bonus depreciation, enter the owner’s distributive share

of the differences between the federal and Idaho depreciation

For credits, this is the owner’s distributive share of the total of:

and gains and losses on these assets reported on Form 41S, line

● The amount of credit earned by the entity, and

32, Form 65, line 30, or Form 66, Schedule B, line 9.

● The amount of any pass-through credit flowing into the entity

Line 9 Idaho Capital Gain (Loss) Eligible for the Idaho

for the tax year

Capital Gains Deduction

For recapture, this is the owner’s distributive share of the total of:

For owners other than C corporations, enter the owner’s

distributive share of gain or loss on the sale of Idaho qualified

property. If the owner is a C corporation, leave this line blank.

● The amount of credit recaptured by the entity, and

● The amount of any pass-through credit recapture flowing into

Include a schedule or use Part E to identify the type of property

the entity for the tax year

sold, the date of sale, and the holding period of the property.

PART E SUPPLEMENTAL INFORMATION

List in Part E any supplemental information required or needed

Line 10 Idaho Technological Equipment Donation

by the owner to complete the Idaho return that isn’t entered

If the owner is a trust or estate, skip line 10. S corporations and

elsewhere on Form ID K-1. If there isn’t enough space provided

partnerships enter the owner’s distributive share of technological

equipment donation reported on Form 41S, line 28, and Form

in Part E to report the information, include additional schedules

65, line 26.

as needed.

Recapture of Credits

Line 11 Other Idaho Subtractions

Enter the owner’s distributive share of any other Idaho

If you reported recapture of credits in Part D, identify the year

subtractions not included on lines 5 through 10 above. Include a

that the credit was originally earned for each amount recaptured

schedule or use Part E to identify the subtractions.

or include a copy of the applicable recapture form reporting this

information.

PART C IDAHO CONTRIBUTIONS

Report all amounts at the owner's distributive share before

Credit for Income Taxes Paid To Another State

Provide information necessary for the computation of the credit

applying the Idaho apportionment factor.

for income taxes paid to another state. This information must be

provided, on a state-by-state basis. Include the owner’s share

Line 1 Contributions to Idaho Educational Entities

Enter the owner’s distributive share of the total amount of

of the amount of tax paid to the other state by the entity and the

qualifying contributions to Idaho educational entities.

owner’s share of the income reported to the other state.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5