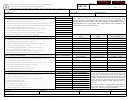

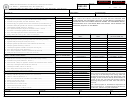

Form Cg-6 - Resident Agent Cigarette Tax Report Page 2

ADVERTISEMENT

Instructions

CG-6 (3/14) (back)

Line instructions

Line 17 — If the amounts on lines 15 and line 16 are not

the same, enter the amount of the difference and attach an

Part I — Report of unstamped cigarettes

explanation as to why the amounts on line 15 and 16 do not

Line 1 — For each pack size enter the number of unstamped

match.

cigarettes (sticks) on hand at the beginning of the month. The

Signature

opening inventory should be the same as the previous month’s

If you are a sole proprietor, you must sign the return and print

closing inventory; attach an explanation if these figures are not

your name, title, e-mail address, telephone number, and date.

the same.

If you are filing this return for a corporation, partnership, or

Line 2 — For each pack size enter the number of unstamped

other type of entity, an officer, employee, or partner must sign

cigarettes (sticks) manufactured, purchased, or otherwise

the return on behalf of the business, and print his or her name,

acquired during the month. Be sure to complete and

title, e-mail address, telephone number, and date.

attach Form CG-6.1, Schedule A — Unstamped Cigarettes

Manufactured, Purchased, or Otherwise Acquired During the

If you do not prepare the return yourself, sign, date, and provide

Month, to substantiate these transactions.

the requested taxpayer information. The preparer must also

print his, her, or the firm’s name, sign the return, and provide

Line 4 — For each pack size enter the number of unstamped

the requested preparer information. Also see Paid preparer

cigarettes (sticks) on hand at the end of the month. The amount

identification numbers.

on line 4 is your closing inventory for this month, and should

also be your opening inventory for next month.

Paid preparer identification numbers

Line 6 — For each pack size enter the number of unstamped

New York State Tax Law requires certain paid tax return

cigarettes (sticks) sold to agencies of the United States.

preparers and facilitators of refund anticipation loans (RALs)

Line 7 — For each pack size enter the number of unstamped

and refund anticipation checks (RACs) to register electronically

cigarettes (sticks) sold to customers, transferred, or returned

with the Tax Department. When completing this section, you

to cigarette manufacturers located outside the state. Be sure

must enter your New York tax preparer registration identification

to complete and attach Form CG-6.2, Schedule C — Sales,

number (NYTPRIN) if you are required to have one. (Information

Transfers, and Returns of Unstamped Cigarettes Outside

on the New York State Tax Preparer Registration Program is

New York State, to substantiate these transactions.

available on our Web site. See Need help? below.) In addition,

you must enter your federal preparer tax identification number

Line 8 — For each pack size enter the number of unstamped

(PTIN) if you have one; if not, you must enter your social security

cigarettes (sticks) sold to customers inside New York State

number (SSN). (PTIN information is available at )

because of their exempt status (e.g., governmental entity,

diplomatic mission or personnel, or the United Nations) or

Where to file

returned to cigarette manufacturers located within the state.

Mail your report and any related schedules and attachments to:

Be sure to complete and attach Form CG-6.3, Schedule D —

Sales, Transfers, and Returns of Unstamped Cigarettes Within

NYS TAX DEPARTMENT

New York State, to substantiate these transactions.

TDAB FACCTS - CIGARETTE TAX

Note: Except for sales to the Oneida Nation of New York, all

W A HARRIMAN CAMPUS

packages of cigarettes sold to Indian nations or tribes or

ALBANY NY 12227

reservation cigarette sellers must be reported on

Private delivery services —

To use a private delivery

Form CG-5.4/6.4, Schedule E — Sale of Cigarettes to Indian

service, see Publication 55, Designated Private Delivery

Nations or Tribes or Reservation Cigarette Sellers. All packages

Services.

of cigarettes sold to the Oneida Nation of New York must be

reported on Part I(B) of Form CG-6.3, Schedule D — Sales,

Transfers, and Returns of Unstamped Cigarettes Within New

Need help?

York State.

If you sell 6,000 or more cartons of cigarettes to any customer

Visit our Web site at

during any one month, remember to report these sales by

(for information, forms, and online services)

attaching a completed Form CG-5.5/6.5, Schedule F — Sales

of Cigarettes Exceeding 6,000 Cartons, to your next quarterly

Miscellaneous Tax Information Center:

(518) 457-5735

report for March, June, September, or December.

To order forms and publications:

(518) 457-5431

Part II — Report of NYS cigarette stamps

Line 11 — Enter the number of unaffixed tax stamps on hand

Text Telephone (TTY) Hotline

(for persons with hearing and

at the beginning of the month for each pack size. This opening

speech disabilities using a TTY):

(518) 485-5082

inventory should be the same as the previous month’s closing

inventory; attach an explanation if these figures are not the same.

Privacy notification

Line 14 — Enter the number of unaffixed tax stamps on hand

The Commissioner of Taxation and Finance may collect and maintain personal information pursuant to

at the end of the month for each pack size. This amount is

the New York State Tax Law, including but not limited to, sections 5-a, 171, 171-a, 287, 308, 429, 475,

your closing inventory for the month, and should also be your

505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security numbers

pursuant to 42 USC 405(c)(2)(C)(i).

opening inventory for the next month.

This information will be used to determine and administer tax liabilities and, when authorized by law, for

certain tax offset and exchange of tax information programs as well as for any other lawful purpose.

Line 16 — Enter the number of tax stamps required to be

Information concerning quarterly wages paid to employees is provided to certain state agencies

affixed to packs of cigarettes during the month for each pack

for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain

employment and training programs and other purposes authorized by law.

size. The total number of tax stamps (both state only and joint-

Failure to provide the required information may subject you to civil or criminal penalties, or both, under

state/city tax stamps) for each pack size must match the amount

the Tax Law.

shown on line 6 of Form CG-5/6-ATT, Schedule B – Cigarette

This information is maintained by the Manager of Document Management, NYS Tax Department,

Packages Stamped During the Month.

W A Harriman Campus, Albany NY 12227; telephone (518) 457-5181.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2