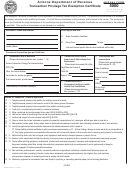

INSTRUCTIONS

Out-of-State Sales, Exemption Certificate Procedures

(a) For little cigars sold by cigarette stamping agents (CSAs) or wholesalers to wholesalers or retailers,

who will sell the little cigars outside the commonwealth, the purchaser (CSA, wholesaler or retailer)

is required to submit to the seller (CSA or wholesaler) an Exemption Certificate (REV-1042).

(b) In lieu of paying the tax on stampable little cigars sold out of state, the seller must obtain a

properly completed Exemption Certificate from the purchaser and retain it for four years after the

date of the sale.

Exemption Certificate Procedure and Forms 72 P.S. § 8209

(a) Every individual sale made by a registered licensed dealer to a registered purchaser exempted from

taxation must include an Exemption Certificate containing the following information:

(1) Dealer’s name, address and license number.

(2) Exempt purchaser’s name and address.

(3) Quantity, brand and price of cigarettes sold.

(4) Signature of authorized representative acknowledging receipt of cigarettes.

(5) Any other information the department may, at its discretion, require.

(b) Each Exemption Certificate must be sent to the department within five days after the date of the sale,

except where continual sales are made by a registered licensed dealer to the same registered exempt

purchaser during a month. In such cases, the registered licensed dealer may retain the certificates

until the last day of the month, after which they are due to the department no later than five days

after the end of the month. A copy of all Exemption Certificates must be retained by the sellers for

four years, in addition to all other records required.

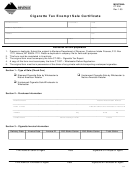

Exemption Certificate Form - This certificate form is available online at or can

be reproduced by any registered licensed dealer, so long as the reproduction contains the same information

and instructions contained in the form issued by the department.

Duty Imposed upon Registered Dealers - Every registered dealer selling tax-free cigarettes to registered

tax-exempt purchasers is required to certify the purchaser has a registration certificate for the current

fiscal year. Any sale made to a purchaser without a valid registration certificate is a violation of PA law.

The Cigarette Tax Exemption Certification is strictly limited to purchases for out-of-state little cigar sales or

transactions coming within the provisions of 72 P.S. § 8209 as amended, which provides as follows:

Section (a) Exemptions from Tax - No tax imposed by this Act shall be levied upon the possession or sale

of cigarettes which this Commonwealth is prohibited from taxing under the Constitution or statutes of the

United States. In addition, the following sales are exempt. Provided, that the seller and purchaser have

registered with the Department and obtained Exemption Certificates.

1. Sales to veteran’s organizations approved by the Department, if the cigarettes are being purchased

by the organization for gratuitous issue to veteran patients in Federal, State or State-aided hospitals.

2. Sales to voluntary unincorporated organizations of military forces personnel operating under regulations

promulgated by the Secretary of Defense or Departments under his jurisdiction.

3. Sales to patients in Veteran’s Administration hospitals by retail dealers located in such hospitals.

1

1 2

2