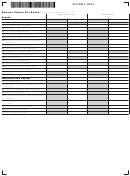

Form 3 - Partnership Return Of Income - 2012 Page 2

ADVERTISEMENT

File pg. 2

FEDERAL IDENTIFICATION NUMBER

2012 FORM 3, PAGE 2

8

Is this partnership under audit by the IRS, or has it been audited in a prior year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

0 0

9

Withholding amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

0 0

10

Payments made with composite return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

0 0

11

Credit for amounts withheld by lower-tier entity(ies). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

0 0

12

Payments made with a composite filing by lower-tier entity(ies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

If showing a loss, mark an X in box at left

5

MASSACHUSETTS ORDINARY INCOME OR LOSS

0 0

13

Ordinary income or loss (from U.S. Form 1065, line 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

0 0

14

Other income or loss (from U.S. Form 1065, Schedule K, line 11). . . . . . . . . . . . . . . . . . . . . . . . . 14

0 0

15

State, local and foreign income and unincorporated business taxes or excises . . . . . . . . . . . . . . . . . . 15

0 0

16

Subtotal. Add lines 13 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

0 0

17

Section 1231 gains or losses included in line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

0 0

18

Subtotal. Subtract line 17 from line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19

Adjustments (if any) to line 18. Enter the line number and amount from U.S. Form 1065 to which the adjustment applies.

0 0

a. Line number

Amount

0 0

0 0

b. Line number

Amount

Total adjustments 19

0 0

20

Massachusetts ordinary income or loss. Combine lines 18 and 19 . . . . . . . . . . . . . . . . . . . . . . 3 20

0 0

21

Net income or loss from rental real estate activities (from U.S. Form 1965, Schedule K, line 2) . . . 21

22

Adjustments (if any) to line 21. Enter the line number and amount from U.S. Form 1065 to which the adjustment applies.

0 0

a. Line number

Amount

0 0

0 0

b. Line number

Amount

Total adjustments 22

0 0

23

Adjusted Mass. net income or loss from rental real estate activities. Combine lines 21 and 22 3 23

0 0

24

Net income or loss from other rental activities (from U.S. Form 1065, Schedule K, line 3c) . . . . . 24

25

Adjustments (if any) to line 24. Enter the line number and amount from U.S. Form 1065 to which the adjustment applies.

0 0

a. Line number

Amount

0 0

0 0

b. Line number

Amount

Total adjustments 25

0 0

26

Adjusted Mass. net income or loss from other rental activities. Combine lines 24 and 25. . . . . 3 26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10