Form 3 - Partnership Return Of Income - 2012 Page 9

ADVERTISEMENT

File pg. 9

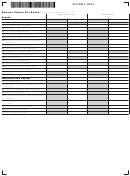

2012 FORM 3, PAGE 9

Balance Sheets Per Books.

From U.S. Form 1065, Schedule L.

Beginning of tax year

End of tax year

Assets

a.

b.

c.

d.

56. Cash

57a. Trade notes and accounts receivable

b. Less allowance for bad debts

58. Inventories

59. U.S. government obligations

60. Federally tax-exempt securities

61. Other current assets (attach statement)

62a. Loans to partners (or persons related to

partners)

b. Mortgage and real estate loans

63. Other investments (attach statement)

64a. Buildings and other depreciable assets

b. Less accumulated depreciation

65a. Depletable assets

b. Less accumulated depletion

66. Land (net of any amortization)

67a. Intangible assets (amortizable only)

b. Less accumulated amortization

68. Other assets (attach statement)

69. Total assets

Liabilities and Capital

a.

b.

c.

d.

70. Accounts payable

71. Mortgages, notes, bonds payable in less than

one year

72. Other current liabilities (attach statement)

73. All nonrecourse loans

74a. Loans from partners (or persons related to

partners)

b. Mortgages, notes, bonds payable in one year

or more

75. Other liabilities (attach statement)

76. Partners’ capital accounts

77. Total liabilities and capital

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10