BOE-400-LTR (S2) REV. 1 (7-12)

SECTION VI: REQUIREMENT TO UPDATE SCHEDULE OF TOBACCO PRODUCTS BRAND FAMILY NAMES

Pursuant to California Business and Professions Code section 22979.21, in order to maintain a license, a

manufacturer or importer must update the list of brand family names it manufactures or imports and provide a

copy to the BOE whenever a new or additional brand is manufactured or imported by the

manufacturer/importer, or a listed brand is no longer manufactured or imported.

Please complete and submit with your renewal application and certification; BOE-400-LT1, Schedule of

Tobacco Products Brand Family Names, included with this Renewal Application.

SECTION VII: CERTIFICATION FOR RENEWAL OF TOBACCO PRODUCTS MANUFACTURER/IMPORTER LICENSE

Manufacturer/Importer certifies that they shall file a monthly report, BOE-501-MIT, Schedule Manufacturer/

to the BOE, in a manner specified by

Importer Report of Tobacco Products Delivered or Shipped Into California,

the BOE, which may include, but is not limited to, electronic media pursuant to California Business and

Professions Code section 22979.21. The monthly report shall include, but is not limited to the following: a list of

all distributors licensed pursuant to section 22975 to which the manufacturer or importer shipped its tobacco

products or caused its tobacco products to be shipped and the total wholesale cost of the products.

It is understood and acknowledged that under California Business and Professions Code section 22980.1, no

manufacturer/importer shall sell cigarettes or tobacco products to a distributor, wholesaler, importer, or any

other person who is not licensed or whose license has been suspended or revoked. Failure to comply with this

section shall be a misdemeanor subject to penalties and fines pursuant to California Business and Professions

Code section 22981.

I certify that all the information provided in this certification is true and accurate and understand that any person

who asserts the truth of any material matter that he or she knows to be false is guilty of a misdemeanor

punishable by imprisonment of up to one year in jail, or a fine of not more than five thousand dollars ($5,000), or

both imprisonment and fine.

This certification must be signed by a corporate officer, LLC member or manager, or an authorized agent, or

partner. For a partnership, attach an authorization signed by all general partners; for a corporation, attach a

corporate resolution; and for a LLC, attach the articles of organization which authorized the individual who signs

below to certify this application. If signed by an authorized agent, a properly completed power of attorney must

be attached to this application.

Note: This document must also be signed and dated in front of an authorized notary public, who also signs as

a witness.

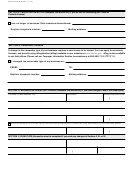

SIGNATURE

TITLE

NAME (typed or printed)

DATE

Subscribed and sworn to before me on this date:

City of:

SIGNATURE OF NOTARY PUBLIC

COMMISSION EXPIRES

If you need additional information, please contact the State Board of Equalization, Special Taxes and Fees, P.O. Box

942879, Sacramento, CA 94279-0088. You may also visit the BOE website at or call the Taxpayer

Information Section at 800-400-7115 (TTY:711); from the main menu, select the option Special Taxes and Fees. Customer

service representatives are available weekdays from 8:00 a.m. to 5:00 p.m. (Pacific time), except state holidays.

CLEAR

PRINT

1

1 2

2 3

3