What you should know before

individual or an individual of a partnership, you

should request the OIC package for individuals

preparing an Offer in Compromise

(BOE-490) from BOE’s website or contact your

Are you an OIC candidate?

local district office. If you are making an offer as

an individual and another entity (corporation, LLC,

The Offer in Compromise (OIC) program is for tax

trust, or organization), both the individual applica

payers or feepayers that do not have, and will not

tion and the corporation application should be

have in the foreseeable future, the income, assets,

filled out respectively.

or means to pay their liability in full. It allows a

taxpayer or feepayer to offer a lesser amount for

Who Qualifies?

payment of a non-disputed final tax liability on a

We will only process your OIC application if:

closed-out account.

• You no longer have a controlling interest or

Effective January 1, 2009 through December 31,

association with the business that incurred the

2012, the OIC program will extend to qualified

liability or a related business.

active businesses where the taxpayer or feepayer

• You are an active business with a final liability

has not received tax or fee reimbursement for tax

that arose from transactions in which you did

and fees owed to the State, to successors of busi

not receive tax or fee reimbursement.

nesses that may have inherited tax liabilities of the

• You are a consumer who accrued use tax.

predecessors, and to consumers who incurred a

• You are a successor that inherited the liability

use tax liability.

of your predecessor.

A qualified active business is an active business

• You have fully completed the OIC application

that does not have, and will not have in the fore

and provided all supporting documentation.

seeable future, the income, assets, or means to

pay their non-disputed board assessed liability in

When should offered funds be submitted?

full, where the Board of Equalization (BOE) finds

You will be notified when your offered amount

no evidence that the taxpayer collected sales or

should be submitted. The funds will be held in the

use tax reimbursement, and the taxpayer has not

form of a non-interest bearing deposit. If your OIC

previously received a compromise.

is denied, the full amount of your deposit will be

Generally, we approve an OIC when the amount

refunded to you, or you may choose to apply the

offered represents the most we can expect

deposit to your liability. Credit interest will not be

to collect within a reasonable period of time.

paid to you on the deposited amount if your offer

Although each case is evaluated based on its own

is denied and subsequently refunded.

merit, we give the following factors strong consid

Should I continue to make installment pay

eration in the evaluation:

ments while my offer is being evaluated?

• ability to pay

Yes. You are required to continue making timely

• equity in the entity’s assets

payments as established in your Installment

• present and future income

Payment Agreement while your offer is being con

• present and future expenses

sidered. The BOE will strive to process your offer

• potential for changed circumstances

and provide a decision within 180 days of receiv

• concealment of assets or existence of fraud

ing a completed application and documentation.

Who should use this application?

Will collection action be suspended while

my offer is being evaluated?

If you are making an offer as a corporation,

LLC, trust, organization or a limited or general

In most cases, no new collection action will be

partnership, please use this application. For an

taken while your offer is being evaluated. How

ever, submitting an offer does not automatically

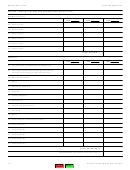

OFFER IN COMPROMISE APPLICATION

3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13