Corporate Application

BOE-490-C REV. 1 (11-08)

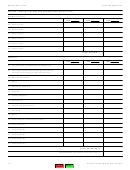

SeCtION 3. Offer AmOuNt

(You are not required to send the offer amount with the application.)

SELLER’S PERMIT OR BOE ACCOUNT NUMBER(S)

PERIOD(S) OF LIABILITY

AMOUNT OWED TO THE BOE

TOTAL AMOUNT OF THE OFFER

$

$

It is understood that this offer will be considered and acted upon as quickly as possible. It does not relieve the taxpayer or feepayer

of the liability sought to be compromised until the BOE accepts the offer and there has been full compliance with all agreements.

The BOE may continue collection activities at its discretion.

Except for any amount deposited in connection with this offer, it is agreed that the BOE will retain all payments and credits made to

the account for the periods covered by this offer. In addition, the BOE will retain any and all amounts to which the tax or feepayer(s)

may be entitled under the California law, due through overpayments of tax or fees, penalty, or interest, prior to the offer being

accepted, not to exceed the liability.

It is further agreed that upon notice to the taxpayer or feepayer of the acceptance of the offer, the taxpayer or feepayer shall have

no right to contest in court or otherwise the amount of the liability sought to be compromised. No liability will be compromised until

all obligations of each taxpayer or feepayer under the compromise agreement are completely performed.

Under penalty of perjury, I declare that I have examined the information given in this statement and all other documents included

with this offer and to the best of my knowledge and belief, they are true, correct, and complete.

SIGNATURE

TITLE

DATE

✍

SIGNATURE

TITLE

DATE

✍

PrOCeSSING ACCePted OfferS

Generally, an offer will not be forwarded for approval until the offer is funded. Once the offer is approved and funded, the OIC Sec

tion will process all the necessary adjustments to your account balance. Releases of liens (if applicable) will be mailed directly to

the county in which they were recorded. The taxpayer or feepayer making the offer will receive copies of the lien release documents

and a statement of balance with the acceptance letter.

Please note that the OIC covers only the final liabilities requested in the OIC application. Any future liabilities that may be assessed

or become final after the date of the compromise are not covered.

PrOCeSSING deNIed OfferS

If we reject or deny the offer, the deposit will be refunded or applied to the liability at the request of the tax or fee payer with an

effective date of the date the funds were received. No interest will be granted on returned deposits. If a third party has posted the

deposited amount, staff must get written permission from the third party to apply the deposit. The case will be returned to the

local district office or headquarters office with a recommendation for case handling based on information analyzed during the offer

process.

Please note: If you choose to make installment payments and the offered amount is not paid within twelve months, your offer will

be denied and all funds received through the offer will be retained.

6

OFFER IN COMPROMISE APPLICATION

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13