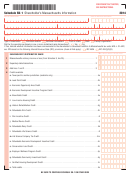

File pg. 2

TAXPAYER IDENTIFICATION NUMBER

SHAREHOLDER’S DISTRIBUTIVE SHARE

(cont’d.)

5

Net income or loss from rental real estate activity(ies) (from Schedule S, line 26) . . . . . . . . . . . . . . . . . . . 5

6

Net income or loss from other real estate activity(ies) (from Schedule S, line 27). . . . . . . . . . . . . . . . . . . . 6

7

Interest from U.S. obligations (from Schedule S, line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8

Interest (5.25%) from Massachusetts banks (from Schedule S, line 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9

Other interest and dividend income (from Schedule S, line 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10

Non-Massachusetts state and municipal bond interest (from Schedule S, line 32) . . . . . . . . . . . . . . . . . . . . . 10

11

Royalty income (from Schedule S, line 33) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

Other income (from Schedule S, line 34). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13

Short-term capital gains (from Schedule S, line 35) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14

Short-term capital losses (from Schedule S, line 36) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15

Gain on the sale, exchange or involuntary conversion of property used in a trade or business held for

one year or less (from Schedule S, line 37) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16

Loss on the sale, exchange or involuntary conversion of property used in a trade or business held for

one year or less (from Schedule S, line 38) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17

Long-term capital gain or loss (from Schedule S, line 39) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18

Net gain or loss under Schedule 1231 (from Schedule S, line 40) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19

Other long-term gains and losses (from Schedule S, line 41) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20

Long-term gains on collectibles (from Schedule S, line 42) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21

Differences and adjustments (from Schedule S, line 43) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22

Property distributions made to shareholder (from U.S. Form 1120S, Schedule K-1, line 16d) . . . . . . . . . 22

1

1 2

2 3

3