File pg. 1

FOR PRIVACY ACT NOTICE,

PRINT IN BL CK INK

SEE INSTRUCTIONS.

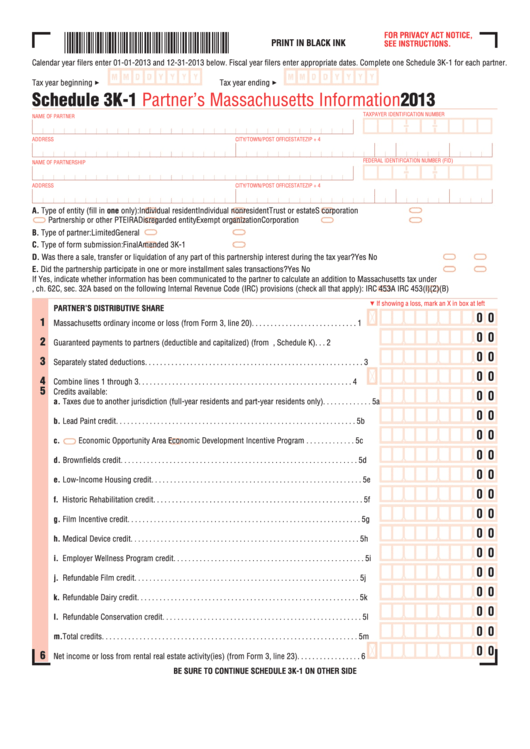

Calendar year filers enter 01-01-2013 and 12-31-2013 below. Fiscal year filers enter appropriate dates. Complete one Schedule 3K-1 for each partner.

Tax year beginning

Tax year ending

Schedule 3 -1

Partner’s Massachusetts Information

2013

TAXPAYER IDENTIFICATION NUMBER

NAME OF PARTNER

ADDRESS

CITY/TOWN/POST OFFICE

STATE

ZIP + 4

FEDERAL IDENTIFICATION NUMBER (FID)

NAME OF PARTNERSHIP

ADDRESS

CITY/TOWN/POST OFFICE

STATE

ZIP + 4

A. Type of entity (fill in one only):

Individual resident

Individual nonresident

Trust or estate

S corporation

Partnership or other PTE

IRA

Disregarded entity

Exempt organization

Corporation

B. Type of partner:

Limited

General

C. Type of form submission:

Final

Amended 3K-1

D. Was there a sale, transfer or liquidation of any part of this partnership interest during the tax year?

Yes

No

E. Did the partnership participate in one or more installment sales transactions?

Yes

No

If Yes, indicate whether information has been communicated to the partner to calculate an addition to Massachusetts tax under

M.G.L., ch. 62C, sec. 32A based on the following Internal Revenue Code (IRC) provisions (check all that apply):

IRC 453A

IRC 453(l)(2)(B)

If showing a loss, mark an X in box at left

5

PARTNER’S DISTRIBUTIVE SHARE

0 0

1

Massachusetts ordinary income or loss (from Form 3, line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

0 0

2

Guaranteed payments to partners (deductible and capitalized) (from U.S. Form 1065, Schedule K) . . . 2

0 0

3

Separately stated deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

0 0

4

Combine lines 1 through 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

Credits available:

0 0

a. Taxes due to another jurisdiction (full-year residents and part-year residents only). . . . . . . . . . . . . 5a

0 0

b. Lead Paint credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

0 0

c.

Economic Opportunity Area

Economic Development Incentive Program . . . . . . . . . . . . . 5c

0 0

d. Brownfields credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5d

0 0

e. Low-Income Housing credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5e

0 0

f. Historic Rehabilitation credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5f

0 0

g. Film Incentive credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5g

0 0

h. Medical Device credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5h

0 0

i. Employer Wellness Program credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5i

0 0

j. Refundable Film credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5j

0 0

k. Refundable Dairy credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5k

0 0

l. Refundable Conservation credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5l

0 0

m.Total credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5m

0 0

6

Net income or loss from rental real estate activity(ies) (from Form 3, line 23). . . . . . . . . . . . . . . . . 6

BE SURE TO CONTINUE SCHEDULE 3K-1 ON OTHER SIDE

1

1 2

2 3

3