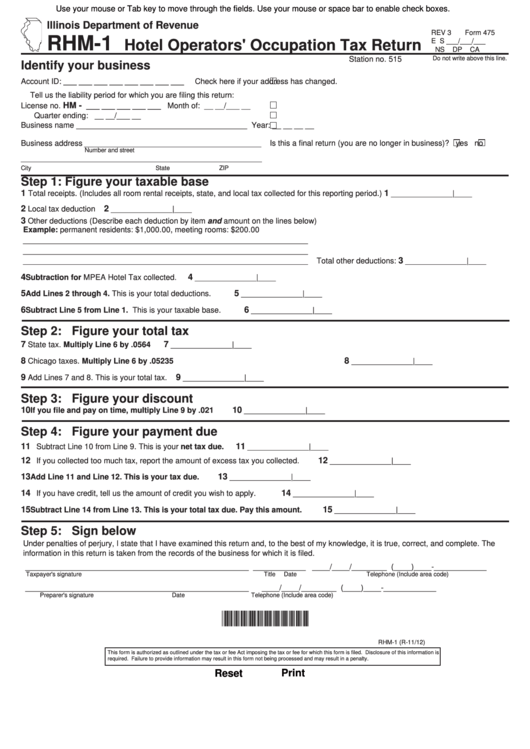

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REV 3

Form 475

RHM-1

E S ___/___/___

Hotel Operators' Occupation Tax Return

NS

DP

CA

Do not write above this line.

Station no. 515

Identify your business

Account ID: ___ ___ ___ ___ ___ ___ ___ ___

Check here if your address has changed.

Tell us the liability period for which you are filing this return:

HM -

License no.

___ ___ ___ ___ ___

Month of: __ __/___ __

Quarter ending: __ __/___ __

Business name

_______________________________________

Year: __ __ __ __

Business address ________________________________________

Is this a final return (you are no longer in business)?

yes

no

Number and street

_______________________________________________________

City

State

ZIP

Step 1: Figure your taxable base

1

1

Total receipts. (Includes all room rental receipts, state, and local tax collected for this reporting period.)

______________|____

2

2

Local tax deduction

______________|____

3

Other deductions (Describe each deduction by item and amount on the lines below)

Example: permanent residents: $1,000.00, meeting rooms: $200.00

_________________________________________________________________

_________________________________________________________________

3

_________________________________________________________________

Total other deductions:

______________|____

4

4

Subtraction for MPEA Hotel Tax collected.

______________|____

5

5

Add Lines 2 through 4. This is your total deductions.

______________|____

6

6

Subtract Line 5 from Line 1. This is your taxable base.

______________|____

Step 2: Figure your total tax

7

7

State tax. Multiply Line 6 by .0564

______________|____

8

8

Chicago taxes. Multiply Line 6 by .05235

______________|____

9

9

Add Lines 7 and 8. This is your total tax.

______________|____

Step 3: Figure your discount

10

10

If you file and pay on time, multiply Line 9 by .021

______________|____

Step 4: Figure your payment due

11

11

Subtract Line 10 from Line 9. This is your net tax due.

______________|____

12

12

If you collected too much tax, report the amount of excess tax you collected.

______________|____

13

13

Add Line 11 and Line 12. This is your tax due.

______________|____

14

14

If you have credit, tell us the amount of credit you wish to apply.

______________|____

15

15

Subtract Line 14 from Line 13. This is your total tax due. Pay this amount.

______________|____

Step 5: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete. The

information in this return is taken from the records of the business for which it is filed.

___________________________________________________

____________

____/____/________ (____)____-____________

Taxpayer's signature

Title

Date

Telephone (Include area code)

___________________________________________________

____/____/________ (____)____-____________

Preparer's signature

Date

Telephone (Include area code)

*247501110*

RHM-1 (R-11/12)

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is

required. Failure to provide information may result in this form not being processed and may result in a penalty.

Reset

Print

1

1