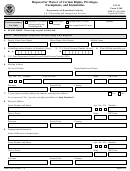

Form 4587 - Michigan Business Tax Schedule Of Recapture Of Certain Business Tax Credits And Deductions - 2014 Page 4

ADVERTISEMENT

NOTE: A sale of qualifying property reported on the

restricted units in accordance with the operation agreement, and

installment method for federal income tax purposes causes

therefore is a recapture event. The lien is payable in the year the

recapture of the entire gross proceeds (including the amount of

recapture event occurs. This recapture is mandatory even if a

the note) in the year of sale, less any gain reflected in federal

taxpayer is otherwise not required to file a return because it does

taxable income (as defined for MBT purposes) in the year of

not meet the filing threshold of $350,000.

the sale. In each subsequent year of the installment note, enter

Enter a recapture amount equal to the full amount of the

zero in line 8a, column E, and enter the gain reflected in federal

deduction allowed to the seller multiplied by a fraction, the

taxable income (as defined for MBT purposes) in column

numerator of which is the difference between 15 and the years

F. For property placed in service prior to January 1, 2008,

the affordable housing project qualified and complied with the

gain reflected in federal taxable income (as defined for MBT

terms of the agreement and the denominator of which is 15.

purposes) is equal to the gain reported for federal purposes.

Line 12 NOTE: There are three different MEGA battery

Line 8a: Enter all dispositions of depreciable tangible assets

credits that are eligible for recapture and are reported on this

included in base investment expenditures that were paid or

line. If the taxpayer has more than one of these credits, enter

accrued after December 31, 2007, and were sold or otherwise

the combined amount of those credits on line 12a.

disposed of during the tax year.

Line 12a: Enter the total amount of the MEGA Battery

• Columns A through D: Enter a brief description of the

Manufacturing Facility Credit, MEGA Large Scale Battery

asset, the city or township in which the asset is located, and

Credit and MEGA Advanced Lithium Ion Battery Credit

the dates that the asset was paid for or accrued and disposed

deemed to be added back to the tax liability by the Michigan

of or sold. To list multiple disposition as one entry, the

Economic Growth Authority.

date the assets were acquired and sold must be the same;

dispositions with variable dates must be listed separately.

Line 12b-c: If reporting recapture for only one of the three

• Column E: Enter the total gross proceeds from the sale or

eligible battery credits, enter the appropriate two-digit code

from the list below in line 12b. If reporting recapture for two

disposition of depreciable tangible assets listed in column A.

credits, enter the appropriate code for one of the recaptured

• Column F: Enter total gain or loss included in calculating

credits on line 12b, and the other on line 12c.

federal taxable income (as defined for MBT purposes).

Miscellaneous MEGA Battery Credit Codes

Lines 9-10: NOTE: The Anchor Company Payroll Credit

and the Anchor Company Taxable Value Credit are claimed

CREDIT

CODE

through an agreement with MEGA. If a taxpayer claimed one

MEGA Battery Manufacturing Facility Credit ..................11

of these credits and subsequently fails to meet requirements of

the MBT Act or conditions of the agreement, the taxpayer must

MEGA Large Scale Battery Credit ................................... 12

recapture the entire amount of such credit previously claimed.

MEGA Advanced Lithium Ion Battery Credit .................. 13

Line 9: Enter the total amount of the Anchor Company Payroll

Credit claimed on previously filed 4584 forms subject to

Line 13: Add lines 1, 2a, 3, 4, 5, 6, 7, 8f, 9, 10, 11, and 12a.

recapture.

Standard taxpayers carry this amount to Form 4567, line 56.

Insurance companies carry this amount to the Form 4588, line

Line 10: Enter the total amount of the Anchor Company

Taxable Value Credit claimed on previously filed 4584 forms

26. Financial Institutions carry this amount to the Form 4590,

line 29.

subject to recapture.

Include completed Form 4587 as part of the tax return filing.

Line 11: Under Michigan Compiled Laws 208.1201(6), the

seller of residential rental units may take a deduction from its

Business Income Tax base, after apportionment, of the gain

from the sale of the residential rental units to a buyer who is a

Qualified Affordable Housing Project (QAHP). To qualify for

a deduction, the seller and buyer must enter into an “operation

agreement” in which the buyer agrees to operate a specific

number of the residential rental units sold as rent restricted

units for a minimum of 15 years. The Department of Treasury

(Treasury) will record a lien against the property subject to

the operation agreement, to enforce the possibility of future

recapture of this deduction.

When the buyer fails to qualify as a QAHP or fails to operate

any of the residential rental units as rent restricted units in

accordance with the operation agreement within 15 years after

the date of purchase, the lien recorded by Treasury becomes

payable to the State. Failure to operate even one residential rental

unit in accordance with an operation agreement constitutes

failure to operate all or some of the residential rental units as rent

154

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4