General Instructions

The aircraft is not based or registered in Illinois after the

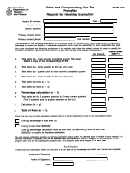

What is the purpose of this form?

purchase.

Purchasers and sellers of aircraft will use RUT-60, Certifi cation For

Prepurchase Evaluation

Aircraft Exemption, to properly claim an exemption when an aircraft is

Tax is not due if the aircraft is temporarily located in Illinois for an

located temporarily in Illinois for one of the following reasons:

examination prior to the purchase and is not based or registered in

• aircraft leaves after the purchase or sale

Illinois after the prepurchase evaluation.

• prepurchase evaluation

• post sale customization.

Post Sale Customization

Keep Form RUT-60 in your books and records to document the

Tax is not due if the aircraft is temporarily located in Illinois for

exemption.

improvement, maintenance, or repair performed on the aircraft after

transfer of ownership and all of the following conditions are met.

What return must be fi led?

The aircraft leaves Illinois within 15 days after the authorized

approval for return to service, completion of the maintenance

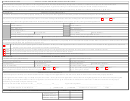

When the item qualifying as an exempt purchase

record entry, and completion of the test fl ight and ground test for

• is sold by an Illinois dealer, it must be reported by the seller on

inspection, as required by 14 C.F.R. 91.407.

Form ST-556, Sales Tax Transaction Return.

The aircraft is not based or registered in Illinois before or after

• is purchased from an out-of-state dealer, it must be reported

the post-sale customization.

by the purchaser on Form RUT-25, Vehicle Use Tax Transaction

Return.

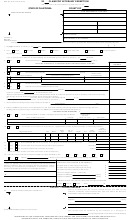

Complete all applicable steps. Keep one copy for your records and mail

• is purchased (or acquired by gift or transfer) from an individual

a copy to:

or other private party, it must be reported by the purchaser

or transferee on Form RUT-75, Aircraft/Watercraft Use Tax

ILLINOIS DEPARTMENT OF REVENUE

Transaction Return.

ROT DISCOVERY

What purchases qualify for tax exemption on

PO BOX 19020

aircraft?

SPRINGFIELD IL 62794-9020

The tax exemption applies to aircraft that leave Illinois after the

purchase or sale, or are temporarily located in Illinois for prepurchase

evaluation or post sale customization. Conditions have to be met

before the exemption is applied.

Aircraft leaves Illinois

Tax is not due if the aircraft is purchased or sold and meets the

following conditions.

The aircraft leaves Illinois within 15 days after the later of either

the issuance

❏ of the fi nal billing for the purchase of an aircraft

❏ or the authorized approval for return to service, completion

of the maintenance record entry, and completion of

the test fl ight and ground test for inspection, as required by

14 C.F.R. 91.407.

RUT-60 back (R-12/10)

1

1 2

2