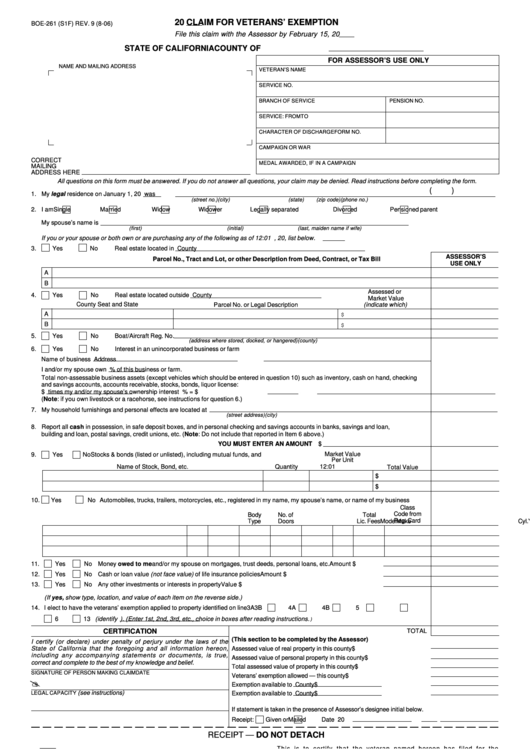

Form Boe-261 - Claim For Veterans' Exemption

ADVERTISEMENT

20

CLAIM FOR VETERANS’ EXEMPTION

BOE-261 (S1F) REV. 9 (8-06)

File this claim with the Assessor by February 15, 20

STATE OF CALIFORNIA

COUNTY OF

FOR ASSESSOR’S USE ONLY

NAME AND MAILING ADDRESS

VETERAN’S NAME

SERVICE NO.

BRANCH OF SERVICE

PENSION NO.

SERVICE: FROM

TO

CHARACTER OF DISCHARGE

FORM NO.

CAMPAIGN OR WAR

CORRECT

MEDAL AWARDED, IF IN A CAMPAIGN

MAILING

ADDRESS HERE

All questions on this form must be answered. If you do not answer all questions, your claim may be denied. Read instructions before completing the form.

(

)

1. My legal residence on January 1, 20

was

(street no.)

(city)

(state)

(zip code)

(phone no.)

2. I am

Single

Married

Widow

Widower

Legally separated

Divorced

Pensioned parent

My spouse’s name is

(first)

(initial)

(last, maiden name if wife)

If you or your spouse or both own or are purchasing any of the following as of 12:01 a.m. January 1, 20

, list below.

3.

Yes

No

Real estate located in

County

ASSESSOR’S

Parcel No., Tract and Lot, or other Description from Deed, Contract, or Tax Bill

USE ONLY

A

B

Assessed or

4.

Yes

No

Real estate located outside

County

Market Value

County Seat and State

(indicate which)

Parcel No. or Legal Description

A

$

B

$

5.

Yes

No

Boat/Aircraft Reg. No.

(address where stored, docked, or hangered)

(county)

6

Yes

No

Interest in an unincorporated business or farm

.

Name of business

Address

I and/or my spouse own

% of this business or farm.

Total non-assessable business assets (except vehicles which should be entered in question 10) such as inventory, cash on hand, checking

and savings accounts, accounts receivable, stocks, bonds, liquor license:

$

times my and/or my spouse’s ownership interest

% = $

(Note: if you own livestock or a racehorse, see instructions for question 6.)

7. My household furnishings and personal effects are located at

(street address)

(city)

8

Report all cash in possession, in safe deposit boxes, and in personal checking and savings accounts in banks, savings and loan,

.

building and loan, postal savings, credit unions, etc. (Note: Do not include that reported in Item 6 above.)

YOU MUST ENTER AN AMOUNT $

Market Value

9.

Yes

No

Stocks & bonds (listed or unlisted), including mutual funds, and U.S. Bonds

Per Unit

Name of Stock, Bond, etc.

Quantity

12:01 a.m. Jan 1

Total Value

$

$

10.

Yes

No Automobiles, trucks, trailers, motorcycles, etc., registered in my name, my spouse’s name, or name of my business

Class

Code from

Body

No. of

Total

Reg. Card

Registered Owner

Year

Make

Type

Doors

Model

Cyl.

Lic. Fees

11.

Yes

No Money owed to me and/or my spouse on mortgages, trust deeds, personal loans, etc.

Amount $

12.

Yes

No Cash or loan value (not face value) of life insurance policies

Amount $

13.

Yes

No Any other investments or interests in property

Value $

(If yes, show type, location, and value of each item on the reverse side.)

14. I elect to have the veterans’ exemption applied to property identified on line

3A

3B

4A

4B

5

6

13 (identify

). (Enter 1st, 2nd, 3rd, etc., choice in boxes after reading instructions.)

CERTIFICATION

TOTAL

(This section to be completed by the Assessor)

I certify (or declare) under penalty of perjury under the laws of the

State of California that the foregoing and all information hereon,

Assessed value of real property in this county

$

including any accompanying statements or documents, is true,

Assessed value of personal property in this county

$

correct and complete to the best of my knowledge and belief.

Total assessed value of property in this county

$

SIGNATURE OF PERSON MAKING CLAIM

DATE

Veterans’ exemption allowed — this county

$

?

Exemption available to

County

$

(see instructions)

Exemption available to

County

$

LEGAL CAPACITY

If statement is taken in the presence of Assessor’s designee initial below.

Receipt:

Given or

Mailed

Date

20

RECEIPT — DO NOT DETACH

This is to certify that the veteran named hereon has filed for the

20

Claim for Veterans’ Exemption received from:

veterans’ exemption under sections 252, 255, and 260 of the Revenue

and Taxation Code of the State of California.

Assessor

County

(designee)

(date)

(Claim must be filed by February 15 each year.)

This receipt must be validated by the Assessor or a designee of

County and presented in case of any misunderstanding.

INFORMATION ON THIS CLAIM MAY BE COMPARED WITH YOUR FEDERAL AND STATE INCOME TAX RETURNS AND IS SUBJECT TO

SUBSEQUENT AUDIT. THIS EXEMPTION CLAIM IS A PUBLIC RECORD AND IS SUBJECT TO PUBLIC INSPECTION.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4