Reset Form

Print Form

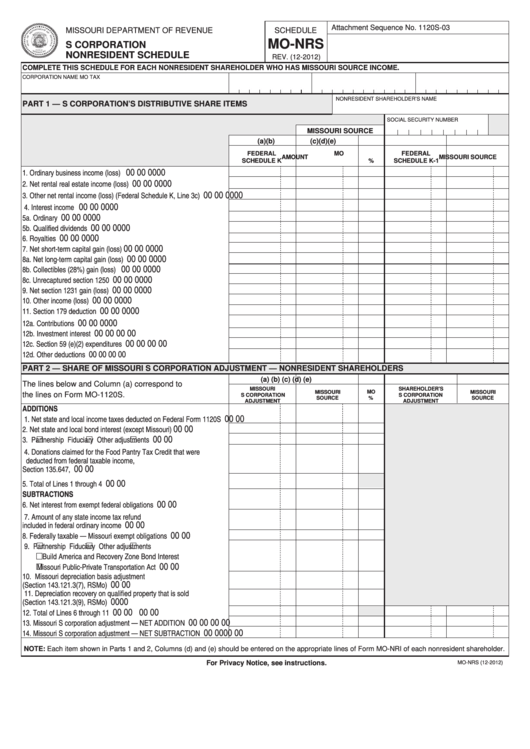

Attachment Sequence No. 1120S-03

MISSOURI DEPARTMENT OF REVENUE

SCHEDULE

MO-NRS

S CORPORATION

NONRESIDENT SCHEDULE

REV. (12-2012)

COMPLETE THIS SCHEDULE FOR EACH NONRESIDENT SHAREHOLDER WHO HAS MISSOURI SOURCE INCOME.

CORPORATION NAME

MO TAX I.D. NUMBER

CHARTER NUMBER

FEDERAL I.D. NUMBER

NONRESIDENT SHAREHOLDER’S NAME

PART 1 — S CORPORATION’S DISTRIBUTIVE SHARE ITEMS

SOCIAL SECURITY NUMBER

MISSOURI SOURCE

(a)

(b)

(c)

(d)

(e)

FEDERAL

MO

FEDERAL

AMOUNT

MISSOURI SOURCE

SCHEDULE K

%

SCHEDULE K-1

00

00

00

00

1. Ordinary business income (loss) ....................................................

00

00

00

00

2. Net rental real estate income (loss) .................................................

00

00

00

00

3. Other net rental income (loss) (Federal Schedule K, Line 3c) .........

00

00

00

00

4. Interest income .................................................................................

00

00

00

00

5a. Ordinary dividends...........................................................................

00

00

00

00

5b. Qualified dividends ..........................................................................

00

00

00

00

6. Royalties ..........................................................................................

00

00

00

00

7. Net short-term capital gain (loss).....................................................

00

00

00

00

8a. Net long-term capital gain (loss) ......................................................

00

00

00

00

8b. Collectibles (28%) gain (loss) .........................................................

00

00

00

00

8c. Unrecaptured section 1250 gain......................................................

00

00

00

00

9. Net section 1231 gain (loss) ............................................................

00

00

00

00

10. Other income (loss) .........................................................................

00

00

00

00

11. Section 179 deduction .....................................................................

00

00

00

00

12a. Contributions ...................................................................................

00

00

00

00

12b. Investment interest expense............................................................

00

00

00

00

12c. Section 59 (e)(2) expenditures ........................................................

00

00

00

00

12d. Other deductions .............................................................................

PART 2 — SHARE OF MISSOURI S CORPORATION ADJUSTMENT — NONRESIDENT SHAREHOLDERS

(a)

(b)

(c)

(d)

(e)

The lines below and Column (a) correspond to

MISSOURI

SHAREHOLDER’S

MISSOURI

MO

MISSOURI

the lines on Form MO-1120S.

S CORPORATION

S CORPORATION

SOURCE

%

SOURCE

ADJUSTMENT

ADJUSTMENT

ADDITIONS

00

00

1. Net state and local income taxes deducted on Federal Form 1120S

00

00

2. Net state and local bond interest (except Missouri).........................

00

00

3.

Partnership

Fiduciary

Other adjustments .................

4. Donations claimed for the Food Pantry Tax Credit that were

deducted from federal taxable income,

00

00

Section 135.647, RSMo...................................................................

00

00

5. Total of Lines 1 through 4 ................................................................

SUBTRACTIONS

00

00

6. Net interest from exempt federal obligations ....................................

7. Amount of any state income tax refund

00

00

included in federal ordinary income .................................................

00

00

8. Federally taxable — Missouri exempt obligations ...........................

9.

Partnership

Fiduciary

Other adjustments

Build America and Recovery Zone Bond Interest

00

00

Missouri Public-Private Transportation Act ................................

10. Missouri depreciation basis adjustment

00

00

(Section 143.121.3(7), RSMo) .........................................................

11. Depreciation recovery on qualified property that is sold

00

00

(Section 143.121.3(9), RSMo) .........................................................

00

00

00

00

12. Total of Lines 6 through 11 ..............................................................

00

00

00

00

13. Missouri S corporation adjustment — NET ADDITION ...................

00

00

00

00

14. Missouri S corporation adjustment — NET SUBTRACTION ...........

NOTE: Each item shown in Parts 1 and 2, Columns (d) and (e) should be entered on the appropriate lines of Form MO-NRI of each nonresident shareholder.

For Privacy Notice, see instructions.

MO-NRS (12-2012)

1

1 2

2