Name of Estate or Trust (as shown on page 1)

Employer Identification Number

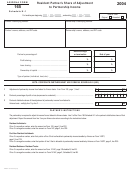

Part II: Net Long-Term Capital Gain Subtraction – Information Schedule

INSTRuCTIONS FOR ThE FIDuCIARY:

Beginning 2013, Arizona allows a subtraction from Arizona gross income for a percentage of any net long-term capital gain from assets

acquired after December 31, 2011 and included in the individual’s federal adjusted gross income or the estate’s or trust’s federal taxable

income.

• If the individual beneficiary’s federal Schedule K-1 (Form 1041) includes an amount for any net capital gain or (loss),

complete line 4, column (b) and line 5, columns (b) through (d).

• If this is the final return for the estate or trust and a capital loss carryover amount was distributed to the beneficiary,

complete line 6, column (b) and line 7, columns (b) through (d).

(a)

(b)

(c)

(d)

Net long-term capital

Net long-term capital

gain or (loss) included

gain or (loss) included

in column (b) from

in column (b) from

Amount reported on

assets acquired before

assets acquired after

Item

federal Schedule K-1

January 1, 2012

December 31, 2011

4 Total net short-term capital gain or (loss) from

Form 141AZ, page 1, line 15b distributed to the beneficiary ...... 4

5 Total net long-term capital gain or (loss) from

Form 141AZ, page 1, line 15c distributed to the beneficiary ...... 5

6 Short-term capital loss carryover(s) distributed to the beneficiary

upon termination of the estate or trust ........................................ 6

7 Long-term capital loss carryover(s) distributed to the beneficiary

upon termination of the estate or trust ........................................ 7

INSTRuCTIONS FOR ThE INDIvIDuAL BENEFICIARY:

The beneficiary should complete the worksheet, Worksheet for Net Long-Term Capital Gain Subtraction for Assets Acquired After

December 31, 2011, to determine the allowable subtraction. The worksheet is included in the instructions for the resident and part-year

resident income tax returns (Arizona Forms 140 and 140PY).

Full-year residents use the amount on line 5, column (d) to figure the allowable subtraction on the worksheet included with

Arizona Form 140.

Part-year residents use only that portion of the amount on line 5, column (d) that is included in your Arizona gross income to figure the

allowable subtraction on the worksheet that is included with Arizona Form 140PY.

INSTRuCTIONS FOR ThE FIDuCIARY BENEFICIARY:

If the net long-term capital gain (loss) on line 5, above, is taxed at the estate or trust level, use the information above to complete the

Worksheet for Net Long-Term Capital Gain Subtraction for Assets Acquired After December 31, 2011, included in the instructions of

Arizona Form 141AZ for the estate or trust.

If the net long-term capital gain (loss) on Part II, line 5, above, is distributed to the beneficiary, use the information above to complete

the Worksheet for Net Long-Term Capital Gain Subtraction for Assets Acquired After December 31, 2011, included in the instructions

of Arizona Form 141AZ. The worksheet will assist the estate or trust in completing the Net Long-Term Capital Gain Subtraction –

Information Schedule on Arizona Form 141AZ, Schedule K-1 or Schedule K-1(NR), for each beneficiary.

Print Form

ADOR 10585 (13)

AZ Form 141AZ Schedule K-1 (2013)

Page 2 of 2

1

1 2

2