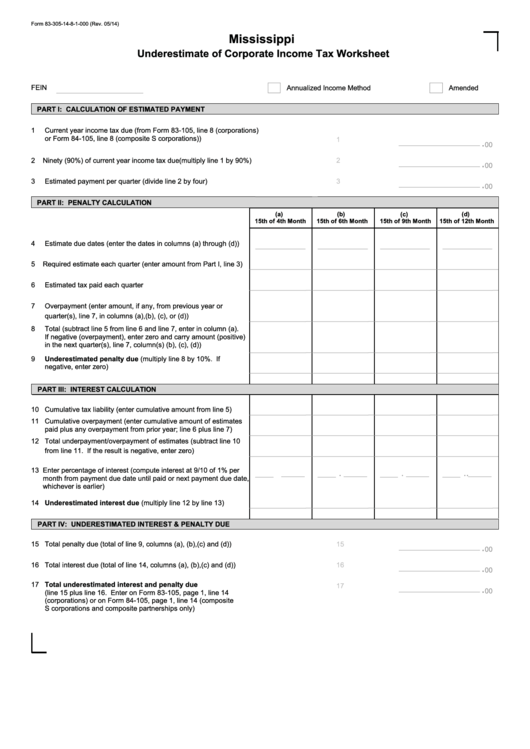

Form 83-305-14-8-1-000 (Rev. 05/14)

Mississippi

Underestimate of Corporate Income Tax Worksheet

FEIN

Amended

Annualized Income Method

PART I: CALCULATION OF ESTIMATED PAYMENT

1

Current year income tax due (from Form 83-105, line 8 (corporations)

or Form 84-105, line 8 (composite S corporations))

1

.

00

2

Ninety (90%) of current year income tax due (multiply line 1 by 90%)

2

.

00

3

Estimated payment per quarter (divide line 2 by four)

3

.

00

PART II: PENALTY CALCULATION

(a)

(b)

(c)

(d)

15th of 4th Month

15th of 6th Month

15th of 9th Month

15th of 12th Month

4

Estimate due dates (enter the dates in columns (a) through (d))

5

Required estimate each quarter (enter amount from Part I, line 3)

6

Estimated tax paid each quarter

7

Overpayment (enter amount, if any, from previous year or

quarter(s), line 7, in columns (a),(b), (c), or (d))

8

Total (subtract line 5 from line 6 and line 7, enter in column (a).

If negative (overpayment), enter zero and carry amount (positive)

in the next quarter(s), line 7, column(s) (b), (c), (d))

9

Underestimated penalty due (multiply line 8 by 10%. If

negative, enter zero)

PART III: INTEREST CALCULATION

10 Cumulative tax liability (enter cumulative amount from line 5)

11 Cumulative overpayment (enter cumulative amount of estimates

paid plus any overpayment from prior year; line 6 plus line 7)

12 Total underpayment/overpayment of estimates (subtract line 10

from line 11. If the result is negative, enter zero)

13 Enter percentage of interest (compute interest at 9/10 of 1% per

.

.

.

.

month from payment due date until paid or next payment due date,

whichever is earlier)

14 Underestimated interest due (multiply line 12 by line 13)

PART IV: UNDERESTIMATED INTEREST & PENALTY DUE

15 Total penalty due (total of line 9, columns (a), (b),(c) and (d))

15

.

00

16 Total interest due (total of line 14, columns (a), (b),(c) and (d))

16

.

00

17 Total underestimated interest and penalty due

17

.

00

(line 15 plus line 16. Enter on Form 83-105, page 1, line 14

(corporations) or on Form 84-105, page 1, line 14 (composite

S corporations and composite partnerships only)

1

1