3

PA 8857 (10-09)

Page

Specific Instructions

Part II—Separation of Liability

Foreign address. Enter the information in the following

You may elect separation of liability relief if you meet one of

order: city, province or state, and country. Follow the coun-

the following conditions at the time you file the election

try’s practice for entering the postal code. Do not abbreviate

packet:

the country name.

•

You are divorced, widowed, or legally separated from the

individual with whom you filed the joint return.

Part I

•

You and the individual with whom you filed the joint return

Spousal Notification

have not been members of the same household at any

time during the 12-month period preceding the date the

The Department is required to inform the non-electing spouse

election packet is filed.

(your spouse or former spouse) of your request for relief from

liability. There are no exceptions even for victims of spousal

Requesting Separation of Liability

abuse or domestic abuse.

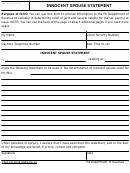

Use PA 12507, Innocent Spouse Statement, to explain why

The Department will contact the non-electing spouse and

you believe you qualify for separation of liability relief. Show

allow him or her to provide information that may assist in

determining your eligibility for relief from joint liability. The

the total amount of the understatement of tax. For each item

Department will also inform the non-electing spouse of its

that resulted in an understatement of tax, explain whether

preliminary and final determinations regarding your request

the item is attributable to you, the person listed on Line 2, or

for relief. However, to protect your privacy, the Department

both of you. For example, unreported income earned by the

will not provide information to the non-electing spouse that

person listed on Line 2 would be allocated to that person. See

could infringe on your privacy. The Department will not pro-

PA Pub. 971 for more details.

vide your new name, address, information about your

employer, phone number, or any other information that does

Exception. If, at the time you signed the joint return, you

not relate to a determination about your request for relief

knew about any item that resulted in part or all of the under-

from liability.

statement, then your request will not apply to that part of the

understatement.

Victim of Domestic Abuse

If you have been a victim of domestic abuse and fear that fil-

Part III—Understatement of Tax Relief

ing an election for relief from joint liability will result in retal-

You may be relieved of joint liability for an understatement of

iation, check the box in Part 1. Checking this box will alert the

tax and the related interest and penalties if all the following

Department to the sensitivity of your situation. It does not

grant you special consideration for purposes of the

conditions are met:

Department’s determination regarding your request for relief.

1.

You filed a joint return which has an understatement

However, evidence of abuses are factors that the Department

of tax due to an erroneous item of your spouse;

may consider for certain types of relief. You should fully

2.

You establish that at the time you signed the joint

explain to the Department your concerns in the statement

return you did not know and had no reason to know

that you attach to your election.

that there was an understatement of tax. (If you

establish that you were the victim of domestic abuse

Line 2

prior to the time you signed your joint return, and

Enter the current name and SSN of your spouse (or former

that, as a result of the prior abuse, you did not chal-

spouse) with whom you filed a joint return for the tax year(s)

lenge the treatment of any items on the return for

listed on Line 1. If the name of the person shown on that

fear of your spouse’s retaliation, you can qualify for

year’s tax return(s) is different from the current name, enter

relief even if you had actual knowledge of your

it in parentheses after the current name. For example, enter

spouse’s understatement of tax.); and

“Jane Maple (formerly Jane Oak).” Also enter the current

address and phone number if you know it.

3.

Taking into account all the facts and circumstances,

it would be unfair to hold you liable for the under-

P.O. Box. Enter the box number instead of the street address

only if you do not know the street address.

statement of tax.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12