4

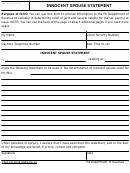

PA 8857 (10-09)

Page

Erroneous Items

•

Why you believe it would be unfair to hold you liable for

Any income, deduction, credit, or reported basis is an erro-

the understatement of tax.

neous item if it is omitted from or incorrectly reported on the

joint return.

Part IV—Income Allocation Relief

Partial Innocent Spouse Relief

You may qualify for relief by income allocation if you are joint-

If you knew about any of the erroneous items, but not the full

extent of the item(s), you may be allowed relief for the part

ly liable for an underpayment of tax, and the underpaid tax is

of the understatement you did not know about. Explain in the

not attributable to income that would have been on your sep-

PA 12507 you attach to Form PA 8857 how much you knew

about the erroneous item, and the reason(s) you did not

arate return if you were to have filed a separate return. In

know and had no reason to know the full extent of the under-

addition, you may qualify for relief by income allocation if you

statement despite your having knowledge or the erroneous

failed to qualify for relief from joint liability for an erroneous

items.

item through your election for relief from an understatement

Requesting Relief by Understatement of Tax

of tax or your election for relief by separation of liability.

Use PA 12507 to explain why you believe you qualify for

understatement of tax relief. The statement will vary depend-

Requesting Relief by Income Allocation

ing on your circumstances, but should include all of the fol-

lowing:

Use PA 12507 to explain why you believe it would be unfair to

•

The amount of the understatement of tax for which you

hold you liable for the tax instead of the person listed on Line

are liable and are seeking relief;

2. If you are attaching a PA 12507 for separation of liability

•

The amount and detailed description of each erroneous

item, including why you had no reason to know about the

or understatement of tax relief, only include any additional

item, or if you did know of the item, the reason you had

information you believe supports your request for income

only partial knowledge, and the extent to which you did

know about the item; and

allocation relief.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12