Reset Form

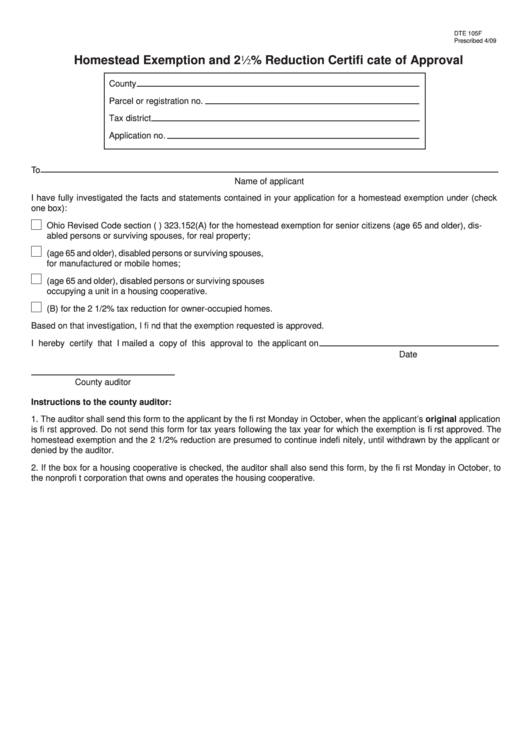

DTE 105F

Prescribed 4/09

Homestead Exemption and 22% Reduction Certifi cate of Approval

County

Parcel or registration no.

Tax district

Application no.

To

Name of applicant

I have fully investigated the facts and statements contained in your application for a homestead exemption under (check

one box):

Ohio Revised Code section (R.C.) 323.152(A) for the homestead exemption for senior citizens (age 65 and older), dis-

abled persons or surviving spouses, for real property;

R.C. 4503.065 for the homestead exemption for senior citizens (age 65 and older), disabled persons or surviving spouses,

for manufactured or mobile homes;

R.C. 323.159 for the homestead exemption for senior citizens (age 65 and older), disabled persons or surviving spouses

occupying a unit in a housing cooperative.

R.C. 323.152(B) for the 2 1/2% tax reduction for owner-occupied homes.

Based on that investigation, I fi nd that the exemption requested is approved.

I hereby certify that I mailed a copy of this approval to the applicant on

Date

County auditor

Instructions to the county auditor:

1. The auditor shall send this form to the applicant by the fi rst Monday in October, when the applicant’s original application

is fi rst approved. Do not send this form for tax years following the tax year for which the exemption is fi rst approved. The

homestead exemption and the 2 1/2% reduction are presumed to continue indefi nitely, until withdrawn by the applicant or

denied by the auditor.

2. If the box for a housing cooperative is checked, the auditor shall also send this form, by the fi rst Monday in October, to

the nonprofi t corporation that owns and operates the housing cooperative.

1

1