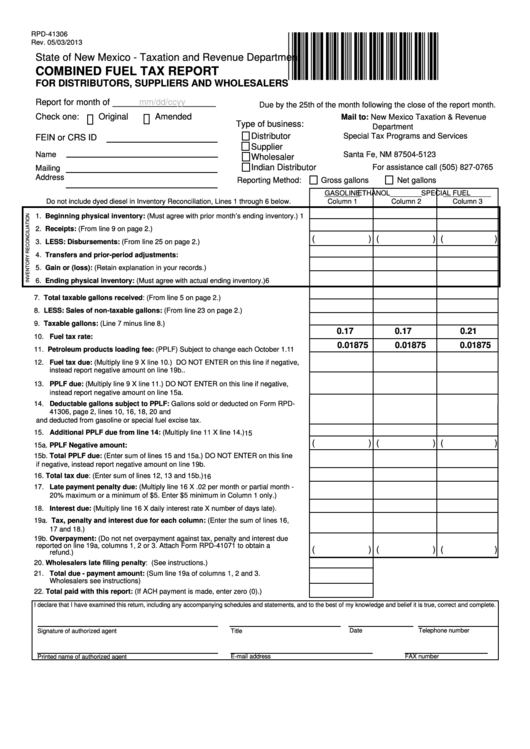

RPD-41306

*96540200*

Rev. 05/03/2013

State of New Mexico - Taxation and Revenue Department

COMBINED FUEL TAX REPORT

FOR DISTRIBUTORS, SUPPLIERS AND WHOLESALERS

__________________

Report for month of

mm/dd/ccyy

Due by the 25th of the month following the close of the report month.

Check one:

Original

Amended

Mail to: New Mexico Taxation & Revenue

Type of business:

Department

Distributor

Special Tax Programs and Services

FEIN or CRS ID

P.O. Box 25123

Supplier

Name

Santa Fe, NM 87504-5123

Wholesaler

Indian Distributor

For assistance call (505) 827-0765

Mailing

Address

Reporting Method:

Gross gallons

Net gallons

GASOLINE

ETHANOL

SPECIAL FUEL

Do not include dyed diesel in Inventory Reconciliation, Lines 1 through 6 below.

Column 1

Column 2

Column 3

1.

Beginning physical inventory: (Must agree with prior month’s ending inventory.) 1

2.

Receipts: (From line 9 on page 2.) ........................................................................... 2

(

) (

) (

)

3.

LESS: Disbursements: (From line 25 on page 2.) .................................................. 3

4.

Transfers and prior-period adjustments: ............................................................. 4

5.

Gain or (loss): (Retain explanation in your records.) ............................................... 5

6.

Ending physical inventory: (Must agree with actual ending inventory.) ................. 6

7.

Total taxable gallons received: (From line 5 on page 2.) ....................................... 7

8.

LESS: Sales of non-taxable gallons: (From line 23 on page 2.) ............................ 8

9.

Taxable gallons: (Line 7 minus line 8.) .................................................................... 9

0.17

0.17

0.21

10. Fuel tax rate: ......................................................................................................... 10

0.01875

0.01875

0.01875

11. Petroleum products loading fee: (PPLF) Subject to change each October 1. .....11

12. Fuel tax due: (Multiply line 9 X line 10.) DO NOT ENTER on this line if negative,

instead report negative amount on line 19b.. .......................................................... 12

13. PPLF due: (Multiply line 9 X line 11.) DO NOT ENTER on this line if negative,

instead report negative amount on line 15a. .......................................................... 13

14. Deductable gallons subject to PPLF: Gallons sold or deducted on Form RPD-

41306, page 2, lines 10, 16, 18, 20 and 22. These gallons are subject to PPLF

and deducted from gasoline or special fuel excise tax. ........................................... 14

15. Additional PPLF due from line 14: (Multiply line 11 X line 14.) ............................ 15

(

) (

) (

)

15a. PPLF Negative amount: .................................................................................... 15a

15b. Total PPLF due: (Enter sum of lines 15 and 15a.) DO NOT ENTER on this line

if negative, instead report negative amount on line 19b. ....................................... 15b

16. Total tax due: (Enter sum of lines 12, 13 and 15b.) ............................................... 16

17. Late payment penalty due: (Multiply line 16 X .02 per month or partial month -

20% maximum or a minimum of $5. Enter $5 minimum in Column 1 only.) ............ 17

18. Interest due: (Multiply line 16 X daily interest rate X number of days late). ........... 18

19a. Tax, penalty and interest due for each column: (Enter the sum of lines 16,

17 and 18.) ............................................................................................................ 19a

19b. Overpayment: (Do not net overpayment against tax, penalty and interest due

reported on line 19a, columns 1, 2 or 3. Attach Form RPD-41071 to obtain a

(

) (

) (

)

refund.) .................................................................................................................. 19b

20. Wholesalers late filing penalty: (See instructions.) ............................................. 20

21. Total due - payment amount: (Sum line 19a of columns 1, 2 and 3.

Wholesalers see instructions) ................................................................................. 21

22. Total paid with this report: (If ACH payment is made, enter zero (0).) ................. 22

I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and complete.

Date

Telephone number

Signature of authorized agent

Title

E-mail address

FAX number

Printed name of authorized agent

1

1