Form ST-7A

Virginia Business Consumer’s

For assistance, call (804)367-8037.

Use Tax Return Worksheet

Name

•

Transfer lines to the corresponding lines on Form ST-7.

Account Number

•

For assistance call (804) 367-8037.

Filing Period (Year/Month)

Do not Mail this Worksheet - Retain for Your Records

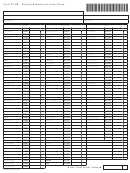

Name and Address of Seller

Description of Property Purchased

Date of Purchase

Cost Price of Property

Purchased

Total Food Purchases - Enter on Line 1, Column A below

Total Other Purchases - Enter on Line 2, Column A below

A-COST PRICE

B-AMOUNT DUE

BUSINESS CONSUMER’S USE TAX

1 Tangible Personal Property Qualifying for State Food Use Tax Rate. Enter cost

price of items used, consumed or stored in Column A. Multiply Column A by the rate of

1.5% (.015) and enter the result in Column B. ................................................................

1

x .015 =

2 Tangible Personal Property Subject to State General Use Tax Rate Enter cost price

of other items used, consumed or stored in Column A (exclude qualifying food reported

on Line 1). Multiply Column A by the rate of 4.3% (.043) and enter the result in Column

B..

2

x .043 =

3 State Tax. Add Line 1, Column B and Line 2, Column B. ...........................................................................................

3

4 RESERVED .................................................................................................................................................................

4

5 RESERVED .................................................................................................................................................................

5

6 Additional State Sales Tax - Regional Transportation. If you used, consumed or stored items in any locality

in the Northern Virginia or Hampton Roads Regions (see table below), complete Lines 6a and 6b. You must also

complete Form ST-6R if you are filing Form ST-6B.

Northern Virginia Region

Hampton Roads Region

Alexandria City

Loudoun County

Chesapeake City

Newport News City

Suffolk City

Arlington County

Manassas City

Franklin City

Norfolk City

Virginia Beach City

Fairfax City

Manassas Park City

Hampton City

Poquoson City

Williamsburg City

Fairfax County

Prince William County

Isle of Wight County

Portsmouth City

York County

Falls Church City

James City County

Southampton County

6a

Northern Virginia. Enter the portion of Line 2,Column A attributable to Northern

Virginia in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

enter the result in Column B. ...................................................................................

6a

x .007 =

6b

Hampton Roads. Enter the portion of Line 2, Column A attributable to Hampton

Roads in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

enter the result in Column B. ...................................................................................

6b

x .007 =

7 Total State and Regional Tax. Add Line 3, Line 6a, Column B and Line 6b, Column B. ..........................................

7

8 Local Use Tax. Enter cost of purchases subject to local use tax in Column A (Line 1,

Column A plus Line 2, Column A). Multiply Column A by the rate of 1.0% (.01). Enter the

result in Column B. Complete Form ST-6B if use tax is due to more than one locality ...

8

x .01 =

9 Total State, Regional and Local Tax. Add Lines 7 and 8, Column B. .......................................................................

9

10 Penalty. Penalty is 6% of Line 9 for each month or part of a month the tax is not paid, not to exceed 30%. The

minimum payment is $10.00, even if tax due is $0 .......................................................................................................

10

11 Interest. Interest is assessed on Line 9 at the rate established in Section 6621 of the Internal Revenue Code of

1954, as amended, plus 2%. For interest rates visit ..............................................................

11

12 Total Amount Due. Add Lines 9, 10 and 11. ..............................................................................................................

12

ST-7A 6201046 Rev. 03/13

1

1 2

2 3

3 4

4 5

5