Form Rv-F1303201 - Application For Qualified Pollution Control Or Certified Green Energy Production

ADVERTISEMENT

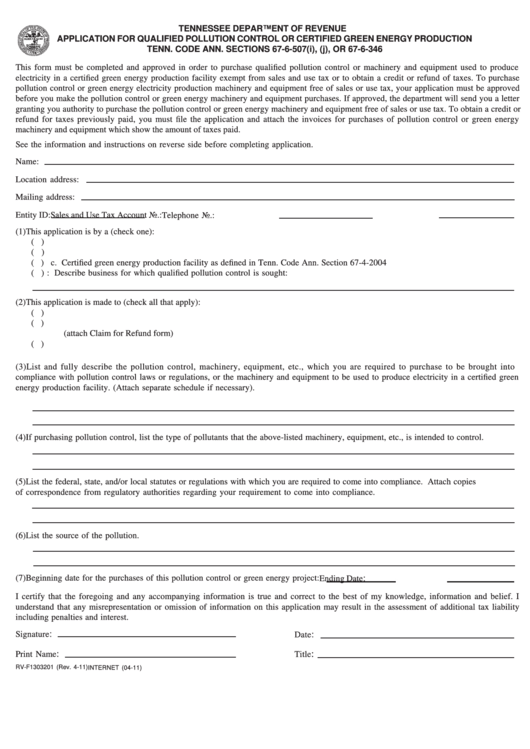

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR QUALIFIED POLLUTION CONTROL OR CERTIFIED GREEN ENERGY PRODUCTION

TENN. CODE ANN. SECTIONS 67-6-507(i), (j), OR 67-6-346

This form must be completed and approved in order to purchase qualified pollution control or machinery and equipment used to produce

electricity in a certified green energy production facility exempt from sales and use tax or to obtain a credit or refund of taxes. To purchase

pollution control or green energy electricity production machinery and equipment free of sales or use tax, your application must be approved

before you make the pollution control or green energy machinery and equipment purchases. If approved, the department will send you a letter

granting you authority to purchase the pollution control or green energy machinery and equipment free of sales or use tax. To obtain a credit or

refund for taxes previously paid, you must file the application and attach the invoices for purchases of pollution control or green energy

machinery and equipment which show the amount of taxes paid.

See the information and instructions on reverse side before completing application.

Name:

Location address:

Mailing address:

Entity ID:

Sales and Use Tax Account No.:

Telephone No.:

(1) This application is by a (check one):

( ) a. Motor vehicle dealer for a paint shop pollution control

( ) b. Dry cleaner for replacement equipment required for pollution control

( ) c. Certified green energy production facility as defined in Tenn. Code Ann. Section 67-4-2004

( ) d. Other: Describe business for which qualified pollution control is sought:

(2) This application is made to (check all that apply):

( ) a. Purchase qualified pollution control or green energy machinery and equipment exempt from sales and use taxes

( ) b. Support a claim for refund for sales and use taxes paid for qualified pollution control or green energy machinery and equipment.

(attach Claim for Refund form)

( ) c. Support a claim for credit for sales and use taxes paid for qualified pollution control or green energy machinery and equipment.

(3) List and fully describe the pollution control, machinery, equipment, etc., which you are required to purchase to be brought into

compliance with pollution control laws or regulations, or the machinery and equipment to be used to produce electricity in a certified green

energy production facility. (Attach separate schedule if necessary).

(4) If purchasing pollution control, list the type of pollutants that the above-listed machinery, equipment, etc., is intended to control.

(5) List the federal, state, and/or local statutes or regulations with which you are required to come into compliance. Attach copies

of correspondence from regulatory authorities regarding your requirement to come into compliance.

(6) List the source of the pollution.

(7) Beginning date for the purchases of this pollution control or green energy project:

Ending Date:

I certify that the foregoing and any accompanying information is true and correct to the best of my knowledge, information and belief. I

understand that any misrepresentation or omission of information on this application may result in the assessment of additional tax liability

including penalties and interest.

Signature:

Date:

Print Name:

Title:

RV-F1303201 (Rev. 4-11)

INTERNET (04-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2