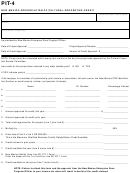

PIT-5

NEW MEXICO QUALIFIED BUSINESS FACILITY REHABILITATION CREDIT

Rev. 09/10/2013

INSTRUCTIONS

page 1

ABOUT THIS CREDIT

The credit for qualified business facility rehabilitation is 50% of the costs of a project for the restoration, rehabilitation or

renovation of qualified business facilities. Claims are limited to three consecutive years and shall not exceed $50,000. Any

portion of the credit that remains unused at the end of the taxpayer's reporting period may be carried forward for four con-

secutive years. Each claim for a qualified business facility rehabilitation credit must be accompanied by certification from the

New Mexico Enterprize Zone Program Officer.

A taxpayer who files a New Mexico individual income tax return and who is not a dependent of another individual and who

is the owner of a qualified business facility may claim the credit. A member/owner of a partnership, LLC, S corporation, joint

venture or similar business association that has qualified for the qualified business facility rehabilitation credit may claim the

credit in proportion to the taxpayer's interest in the business association. The member/owner must complete Section A.

A taxpayer may claim this credit if:

1. the taxpayer submitted a plan and specifications for restoration, rehabilitation or renovation to the New Mexico Enter-

prise Zone Program Officer and received approval, and

2. the taxpayer received certification from the New Mexico Enterprise Zone Program Officer after completing the restora-

tion, rehabilitation or renovation that it conformed to the plan and specifications.

A husband and wife who file separate returns for a reporting period in which they could have filed a joint return may each

claim only one-half of the credit that would have been allowed on a joint return.

"Qualified business facility" means a building located in a New Mexico enterprise zone that is suitable for use and is put into

service by a person in the manufacturing, distribution or service industry immediately following the restoration, rehabilita-

tion or renovation project; provided, the building must have been vacant for the 24-month period immediately preceding the

commencement of the restoration, rehabilitation or renovation project.

"Restoration, rehabilitation or renovation" includes the construction services necessary to ensure that a building is in compli-

ance with applicable zoning codes, is safe for occupancy, and meets the operating needs of a person in the manufacturing

distribution or service industry; and expansion of or an addition to a building if the expansion or addition does not increase

the usable square footage of the building by more than 10% of the usable square footage of the building prior to the restora-

tion, rehabilitation or renovation project.

NOTE: No qualified business facility rehabilitation credit is allowed for cultural or historic properties nor for costs qualifying

for credit under the Investment Credit Act.

HOW TO COMPLETE THIS FORM

Complete all information requested in the address block. Enter the date of the project approval and the date of the credit

approval. Also, enter the project approval number and the amount of the credit approved.

Section A. Complete this section if the project is owned by one or more members/owners of a partnership, limited liability

corporation, S corporation, joint venture or similar business association. If additional space is needed, attach a separate

page.

Line 1.

Enter amount of the project that was approved for the current tax year.

Line 2.

Enter amount approved for the project in prior tax years, if applicable.

Line 3.

Enter the sum of lines 1 and 2. This is the total amount approved for this project.

Line 4.

Multiply line 3 by 50%.

Line 5.

Enter the product of line 3 x line 4 or $50,000 whichever is less.

Line 6.

Credit allowed for claimant. If applicable, multiply line 5 by the claimant's ownership percentage from Schedule

A. If one or more members/owners of a partnership, limited liability corporation, S corporation, joint venture or

similar business association own the property upon which the project is performed, the claimant may only claim

1

1 2

2 3

3