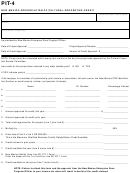

PIT-5

NEW MEXICO QUALIFIED BUSINESS FACILITY REHABILITATION CREDIT

Rev. 09/10/2013

INSTRUCTIONS

page 2

an amount of a credit in proportion to the claimant's interest in the business association. The claimant is the tax-

payer who is filing the New Mexico income tax return and claiming the credit on their return.

Line 7.

Credit claimed by the claimant in prior years for this project. Enter the amount of credit claimed in previous

years, for this project.

Line 8.

Credit available to the claimant during the current tax year. Subtract line 7 from line 6.

Line 9.

Credit applied to the current tax year. The credit applied to the current tax year cannot exceed line 8 or the

amount of net New Mexico income tax from Form PIT-1, line 22, computed before applying the credit.

Line 10.

Credit available to the claimant for carry forward to subsequent years. Subtract line 9 from line 8.

NOTE: The amount of the credit to be applied to the current return is reported on Schedule PIT-CR or FID-CR.

HOW TO APPLY FOR THIS CREDIT

A taxpayer may claim this credit by attaching a completed Form PIT-5 to the personal income tax return or the fiduciary

income tax return for the current year, along with Schedule PIT-CR or FID-CR. Also attach the approval issued by the New

Mexico Enterprise Zone Program Officer of the Economic Development Department. The claim must be submitted with the

tax return for the year in which the restoration, rehabilitation or renovation is carried out.

Mail the tax return and attachments to: New Mexico Taxation and Revenue Department, P O Box 25122, Santa Fe, NM

87504-5122.

CONTACTS

For the New Mexico Enterprise Zone Program Officer, contact:

New Mexico Economic Development Department

Community Development Team Leader

1100 So. St. Francis Drive

Santa Fe, NM 87505

(505) 827-0089

For information related to claiming the credit for qualified business facility rehabilitation against personal income tax,

contact:

New Mexico Taxation and Revenue Department

at (505) 827-6811 in Santa Fe, NM

or your local district office

If claiming the credit on the fiduciary income tax return, mail the return and attachments to the address on Form FID-1.

Call (505) 827-0825 for assistance claiming the credit.

1

1 2

2 3

3