Form Cert-140 - Solar Heating Systems, Solar Electricity Generating Systems, And Ice Storage Cooling Systems

ADVERTISEMENT

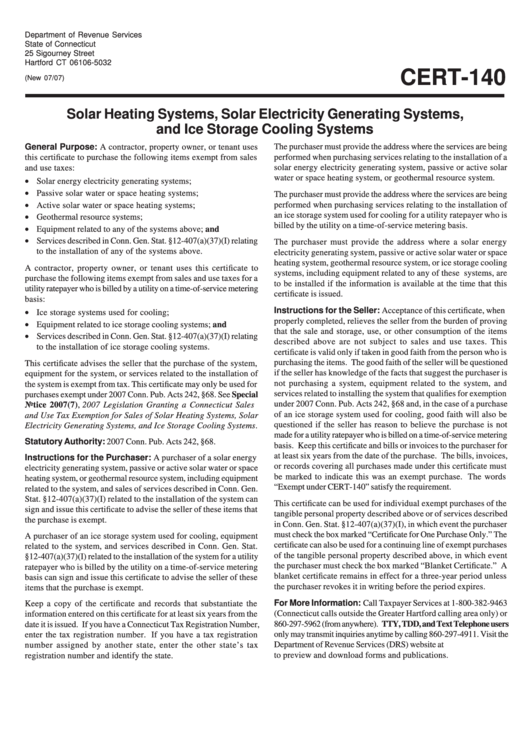

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

CERT-140

(New 07/07)

Solar Heating Systems, Solar Electricity Generating Systems,

and Ice Storage Cooling Systems

General Purpose:

A contractor, property owner, or tenant uses

The purchaser must provide the address where the services are being

performed when purchasing services relating to the installation of a

this certificate to purchase the

following items exempt from sales

solar energy electricity generating system, passive or active solar

and use taxes:

water or space heating system, or geothermal resource system.

• Solar energy electricity generating systems;

• Passive solar water or space heating systems;

The purchaser must provide the address where the services are being

• Active solar water or space heating systems;

performed when purchasing services relating to the installation of

• Geothermal resource systems;

an ice storage system used for cooling for a utility ratepayer who is

billed by the utility on a time-of-service metering basis.

• Equipment related to any of the systems above; and

• Services described in Conn. Gen. Stat. §12-407(a)(37)(I) relating

The purchaser must provide the address where a solar energy

to the installation of any of the systems above.

electricity generating system, passive or active solar water or space

heating system, geothermal resource system, or ice storage cooling

A contractor, property owner, or tenant uses this certificate to

systems, including equipment related to any of these systems, are

purchase the following items exempt from sales and use taxes for a

to be installed if the information is available at the time that this

utility ratepayer who is billed by a utility on a time-of-service metering

certificate is issued.

basis:

• Ice storage systems used for cooling;

Instructions for the Seller: Acceptance of this certificate, when

properly completed, relieves the seller from the burden of proving

• Equipment related to ice storage cooling systems; and

that the sale and storage, use, or other consumption of the items

• Services described in Conn. Gen. Stat. §12-407(a)(37)(I) relating

described above are not subject to sales and use taxes. This

to the installation of ice storage cooling systems.

certificate is valid only if taken in good faith from the person who is

purchasing the items. The good faith of the seller will be questioned

This certificate advises the seller that the purchase of the system,

if the seller has knowledge of the facts that suggest the purchaser is

equipment for the system, or services related to the installation of

not purchasing a system, equipment related to the system, and

the system is exempt from tax. This certificate may only be used for

services related to installing the system that qualifies for exemption

purchases exempt under 2007 Conn. Pub. Acts 242, §68. See Special

under 2007 Conn. Pub. Acts 242, §68 and, in the case of a purchase

Notice 2007(7), 2007 Legislation Granting a Connecticut Sales

of an ice storage system used for cooling, good faith will also be

and Use Tax Exemption for Sales of Solar Heating Systems, Solar

questioned if the seller has reason to believe the purchase is not

Electricity Generating Systems, and Ice Storage Cooling Systems.

made for a utility ratepayer who is billed on a time-of-service metering

Statutory Authority: 2007 Conn. Pub. Acts 242, §68.

basis. Keep this certificate and bills or invoices to the purchaser for

at least six years from the date of the purchase. The bills, invoices,

Instructions for the Purchaser: A purchaser of a solar energy

or records covering all purchases made under this certificate must

electricity generating system, passive or active solar water or space

be marked to indicate this was an exempt purchase. The words

heating system, or geothermal resource system, including equipment

“Exempt under CERT-140” satisfy the requirement.

related to the system, and sales of services described in Conn. Gen.

Stat. §12-407(a)(37)(I) related to the installation of the system can

This certificate can be used for individual exempt purchases of the

sign and issue this certificate to advise the seller of these items that

tangible personal property described above or of services described

the purchase is exempt.

in Conn. Gen. Stat. §12-407(a)(37)(I), in which event the purchaser

must check the box marked “Certificate for One Purchase Only.” The

A purchaser of an ice storage system used for cooling, equipment

certificate can also be used for a continuing line of exempt purchases

related to the system, and services described in Conn. Gen. Stat.

of the tangible personal property described above, in which event

§12-407(a)(37)(I) related to the installation of the system for a utility

the purchaser must check the box marked “Blanket Certificate.” A

ratepayer who is billed by the utility on a time-of-service metering

blanket certificate remains in effect for a three-year period unless

basis can sign and issue this certificate to advise the seller of these

the purchaser revokes it in writing before the period expires.

items that the purchase is exempt.

For More Information: Call Taxpayer Services at 1-800-382-9463

Keep a copy of the certificate and records that substantiate the

(Connecticut calls outside the Greater Hartford calling area only) or

information entered on this certificate for at least six years from the

860-297-5962 (from anywhere). TTY, TDD, and Text Telephone users

date it is issued. If you have a Connecticut Tax Registration Number,

only may transmit inquiries anytime by calling 860-297-4911. Visit the

enter the tax registration number. If you have a tax registration

Department of Revenue Services (DRS) website at

number assigned by another state, enter the other state’s tax

to preview and download forms and publications.

registration number and identify the state.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2